Month: November 2016

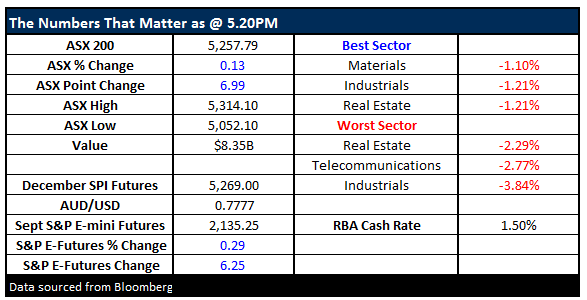

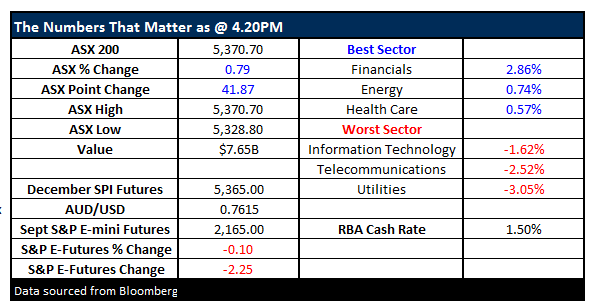

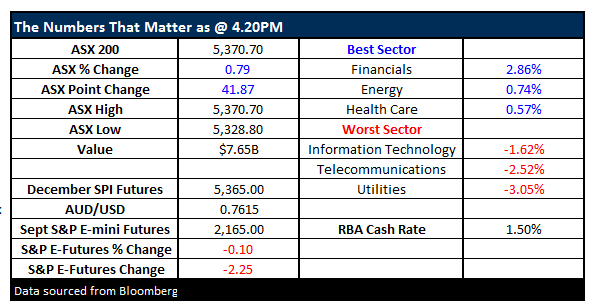

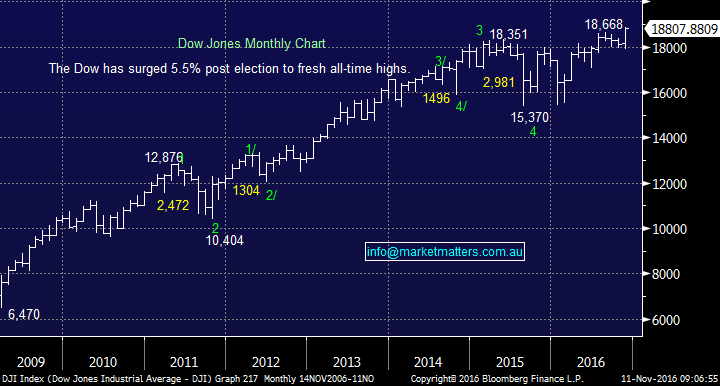

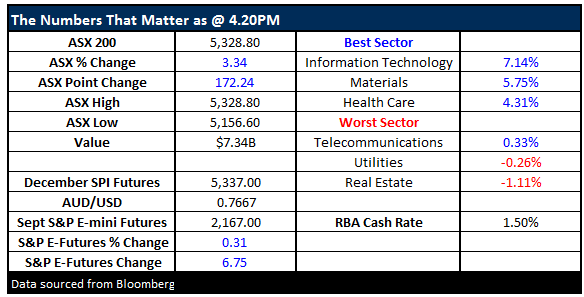

The market trends since the US election continued unabated last night, adding weight to our view that some major inflection points have occurred. Three things caught our eye last night and they have large ramifications for our local stocks:

Where’s the next elastic band?

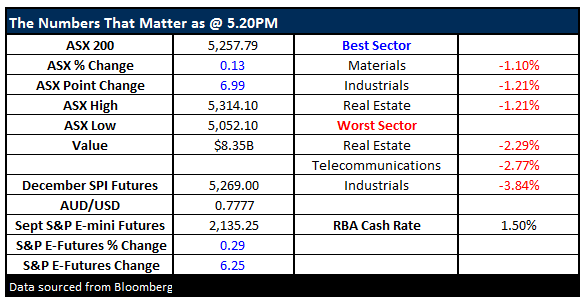

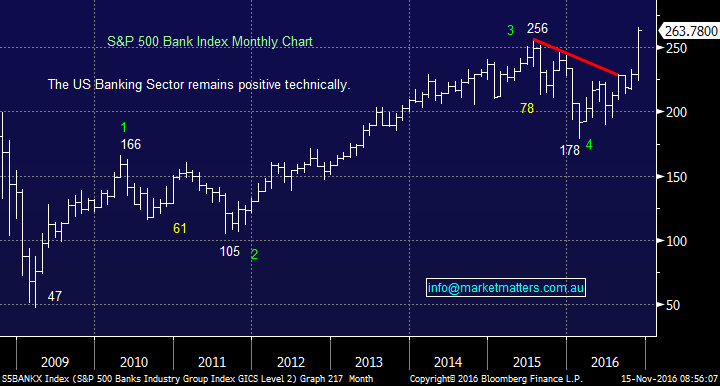

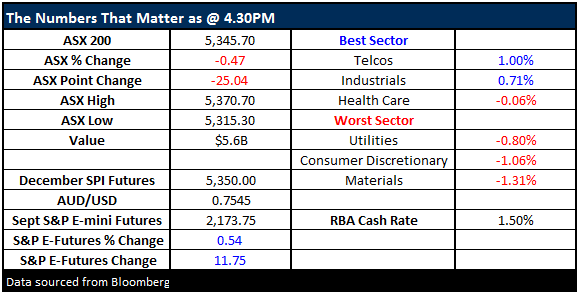

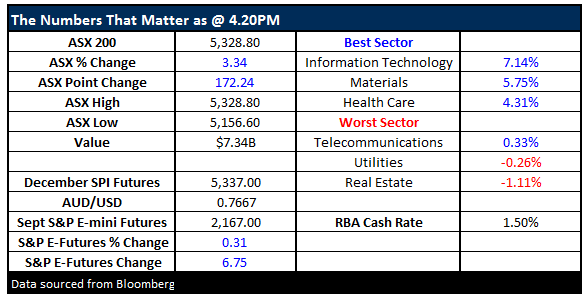

Last night the Dow made all-time highs on continued optimism following Donald Trump’s election victory. However it should be noted the strength was very sector specific, even the different US indices themselves witnessed diverse performances e.g. the Dow +1.2%, the S&P500 +0.2%, Russell 3000 +0.3% but the Tech. NASDAQ -1.6%. There were again some clear standouts both ways within the S&P’s 11 sectors:

Yesterday Donald Trump shocked the world and became the 45th American President. It certainly proves one thing – polls are a total waste of time, a bit like rating agencies over the last decade. One initial observation is this feels a sign that other European countries may follow the UK and push back against the EU as the average Western person is clearly disenchanted. Overnight the US market chased stocks that would benefit from Trump’s perceived policies which coincidentally, these are largely the inflation stocks. My only comment on the election is a positive one for our children: “Like him or not, Donald Trump has shown us all that a person can achieve anything if they put their mind to it” – Market Matters.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.