Month: November 2016

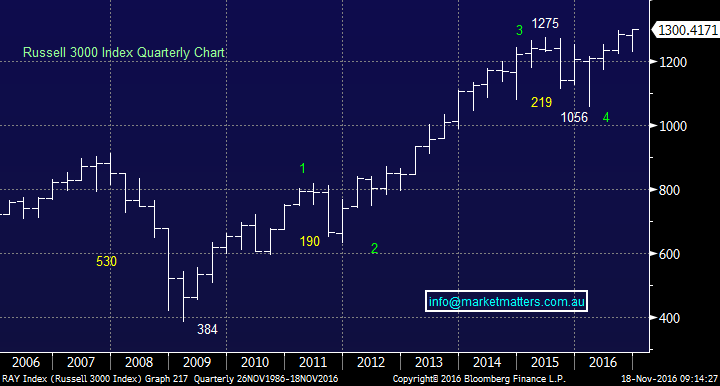

Today we are going look at the 13 stocks in the MM Portfolio hopefully giving clarity on our current thought process and plan moving forward. However firstly we will recap our medium term view for stocks which obviously has a significant bearing on our investment intentions over coming months / years. We have used the Russell 3000 quarterly chart to illustrate our views as it’s longer term and a broad index being based on the 3000 largest US listed stocks by market capitalisation.

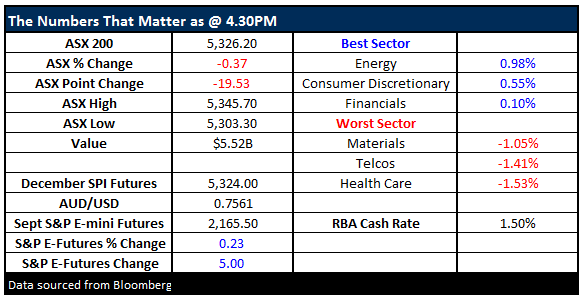

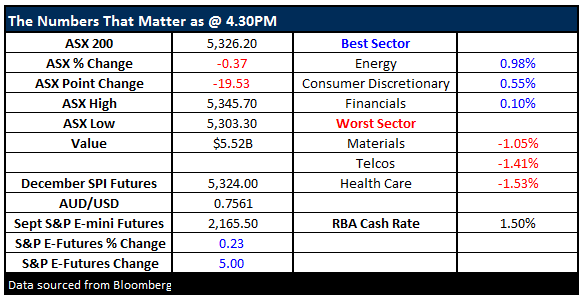

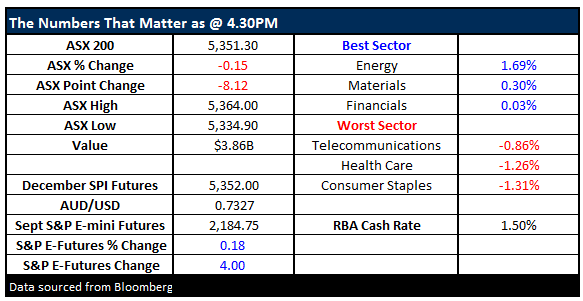

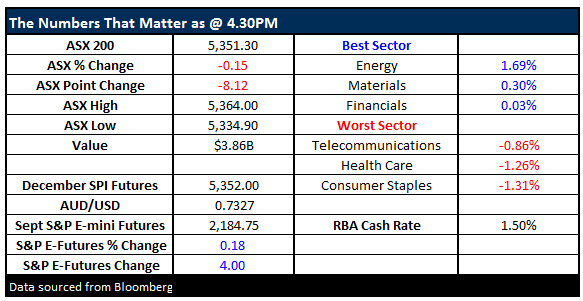

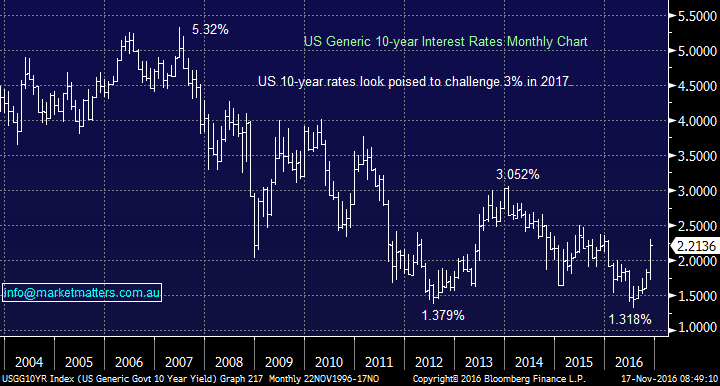

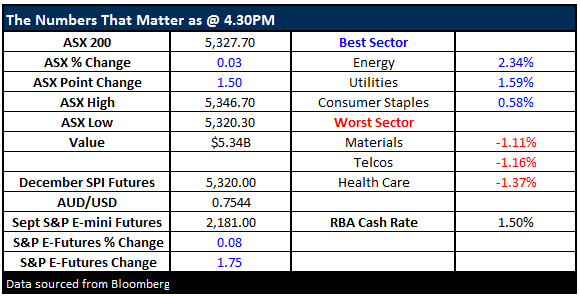

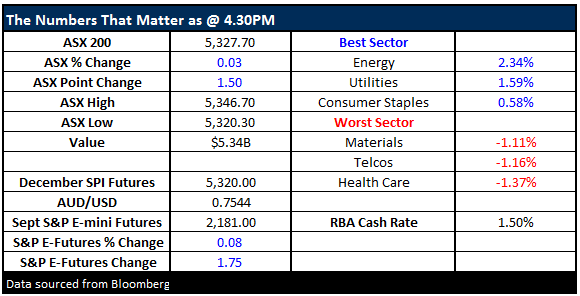

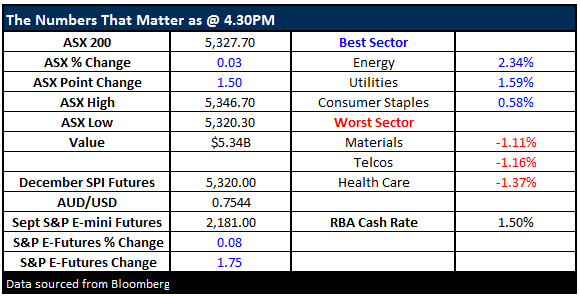

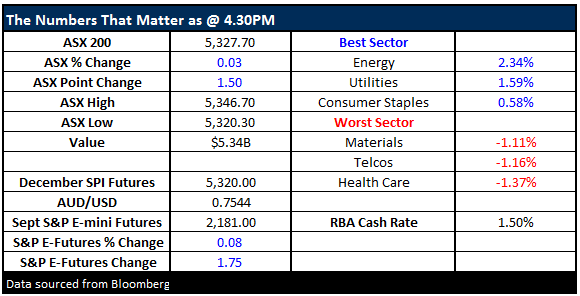

We have been discussing rising US interest rates at length over recent weeks but now feel the initial sharp increase has probably run its course. US 10-year bonds have been hammered sending their interest rate up from 1.32% to touch 2.3%, with over half of these gains unfolding in a frenzy since Donald Trump’s surprise victory. The press is now full of rising interest rate stories and while we feel US 10-year bond rates do eventually head to 3% and probably beyond, a rest is now due – similar to our view on resources this week. Rising interest rates has also occurred locally with our 10-year bonds increasing from 1.8% to 2.7%, the RBA will probably remain on hold well into 2017 but the futures markets are now factoring in more chance of a hike than a cut for next year for Australia. Outside of the main banks mortgage rates have been ticking up as the lenders funding costs rise.

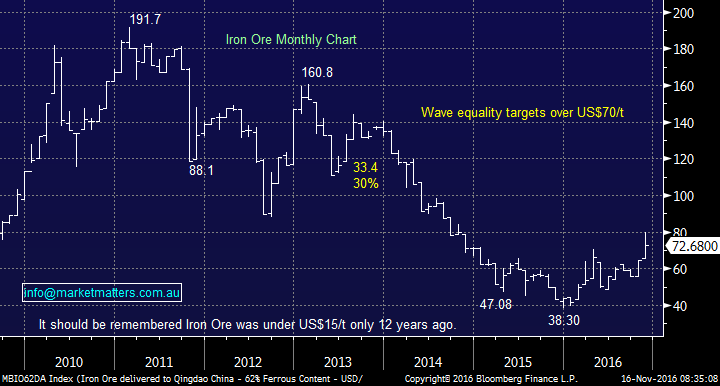

We discussed in the Weekend Report and again yesterday afternoon our concern that resource stocks had rallied too far, too fast, and that we were advocating taking at least 50% profits on resource stocks. So far this week resource stocks have struggled but last night’s 6.5% plunge in the iron price is likely to accelerate this pullback. Remember, our bullish outlook for the $US is a clear headwind to commodity prices.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.