Month: June 2016

Looking for opportunities in 5 stocks that BREXIT fears are hitting Slowly next week’s BREXIT vote approaches with even Janet Yellen saying the Fed considered the UK’s pending vote when not raising interest rates this morning. However, we believe with the US economic data disappointing over recent times the Fed is now unlikely to be in a position to raise interest rates twice in 2016, compared to the anticipated four increases only last December. In fact, the market is now pricing the next interest rate hike in 2017 – not 2016.

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

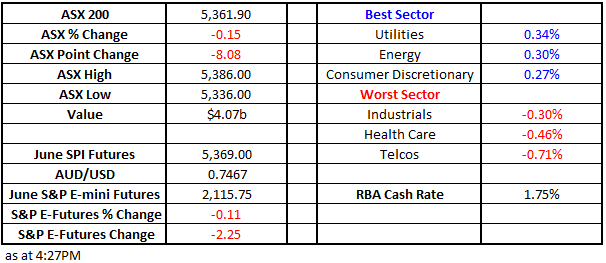

Three markets we are currently watching very closely On the surface, markets feel very quiet with US stocks only 0.8%, below their all-time high and the S&P500 noticeably moving less than 0.5% for 9 consecutive days. The ASX200 remains around the 5400 area, where it has treaded water for the last 5 weeks and it currently feels like the end of financial year (EOFY) may become a non-event for our local stocks. With the BREXIT vote looming in 2 weeks and the market keen to see whether last week’s poor US unemployment data was a once off, it’s easy to predict a few more weeks of relative calm for stock markets. However its often during these very periods of market consolidation / relative inactivity that large moves commence, just after complacency sets in and stocks move earlier than expected in anticipation of future good or bad news. We are watching three markets closely at present that may determine our next investment decisions. We are currently holding ~36% in cash, we regard this large holding as comparatively aggressive to when we went 97% fully invested in stocks near the lows of 2016, but we are prepared to go higher into cash if circumstances dictate. ASX200 Weekly Chart

Why haven’t we bought insurance stocks this week? We are currently sitting on relatively high levels of cash, looking for opportunities as we are bullish stocks for the months ahead. Hence with insurance stocks being hit this week, due to the awful east coast storms, subscribers have understandably been asking why we have not taken the plunge into the sector. The decision to date has been a combination of factors, which hopefully this morning’s report will shed some light on. Firstly, when we look at the insurance sector as a whole, technically we can see a further 10-15% upside, but this is not the clearest chart pattern around at present – we will look at our preferred two stocks in the sector later. Storms / accidents are part of doing business for insurance companies and if we are headed for extreme weather changes in years to come, premiums will simply rise. However, as with resource companies not being seen as Market Matters’ core portfolio holdings, as they cannot determine their own profitability year on year, the same could be said for insurance companies. ASX200 Insurance Index Monthly Chart Technically QBE looks good risk / reward buying under $12, as stops can be run below $11.50. On a macro level, QBE will benefit from rising US interest rates and a lower $A, as it holds funds in the US, and invests their insurance float largely in bonds however it must be cautioned that the market’s opinion on these two variables changes regularly, and is driven largely by policy settings and rhetoric, which as we know, will likely be the source of volatility over the coming months and even years. The other important factor for QBE is the negative trends in Commercial Insurance premiums globally, which is clearly a headwind for earnings. QBE Insurance (QBE) Monthly Chart

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.