Month: June 2016

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

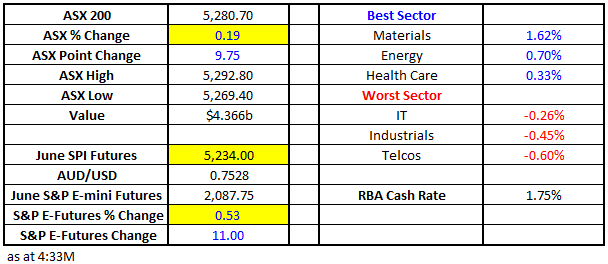

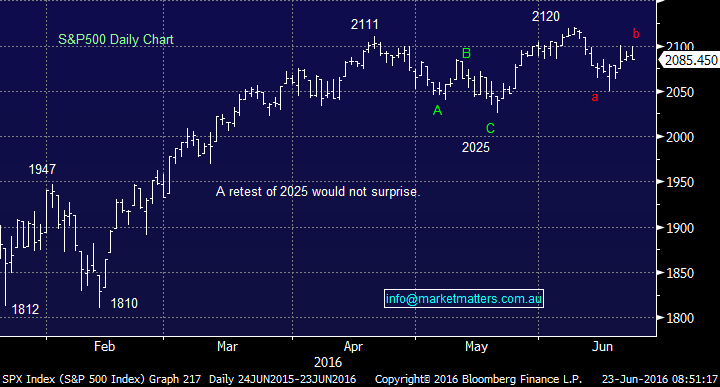

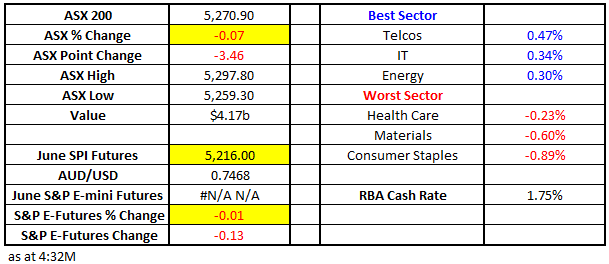

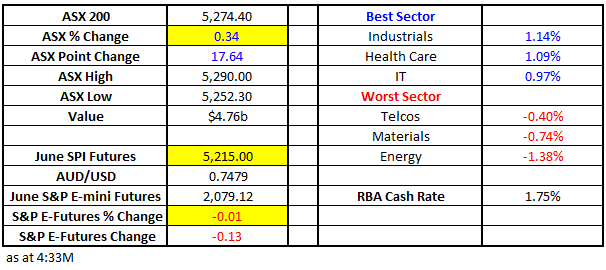

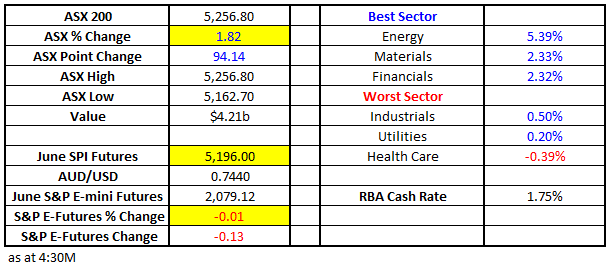

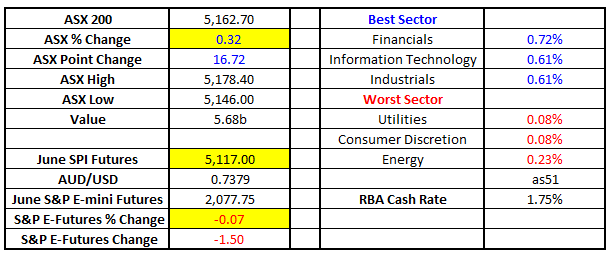

Looking through smoke that’s surrounding markets It’s amazing that an Australian election next month is being ignored by the local stock market but that’s the power and importance of the BREXIT vote. We also have Janet Yellen speaking tonight in front of the Senate Banking Panel as part of her two-day semi-annual testimony – but it’s getting very little attention. The UK staying or leaving the EU is a binary outcome that will be determined by Thursday’s vote and the subsequent trading on Friday is likely to be historic in its nature. At Market Matters, we like to combine both technical and fundamental analysis with this week’s anticipated volatility requiring an extremely clear thought process. Markets often tell us the outcome of events beforehand and hence must be watched closely. The recent price action in most markets from the VIX, currencies, bonds and stocks tells us that investors have understandably positioned themselves very cautiously. Yesterday’s surge in stocks, as the “Remain vote” appeared to edge ahead in the polls, clearly illustrated the mountains of cash sitting on the sidelines and in safe havens like gold and bonds. We still believe that a BREXIT will not occur assigning it a 30% weighting BUT that remains a huge risk for an event that will potentially affect equities for much of 2016. Let’s have a simple look at what markets are showing us today…..we look forward to a fresh market next week when the BREXIT vote will no longer be the only game in town! The ASX200 remains neutral but a close over 5275 and especially 5300 will be bullish, likely to be challenged early today. The obvious key to equities is how much of the “piles of cash on the sidelines” will venture back into stocks if the EU remains united. The ASX200 Daily Chart

Beware the obvious trade! Slowly but surely from around 2013 to 2015 many retail Australian investors began adopting the simple attitude of “just buy the banks, they are the safe place to be”. It’s easy to imagine how this dangerous thought evolved with the local banking index doubling between 2011 and early 2015. Plus of course, there were the dividends, with many financial advisors saying “KISS” buy the banks with their large fully franked dividends, when compared to falling term deposits, makes them the safe and obvious investment. Unfortunately the rest is history as Australian banks have fallen around 30% since March 2015 BUT interest rates have continued to fall with the Australian 10-year bond rate dipping under 2% for the first time in history last week. We received numerous emails when we put out a sell on the banks in early 2013, some of them almost aggressive, perhaps a useful indicator for the future! Please don’t think this report is Market Matters beating its own drum as we have since bought back into banks and our positions are currently losing money – they fell further than we anticipated. This report isabout another issue / concern we see on the horizon. The Australian Banking Sector Monthly Chart

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.