Month: March 2016

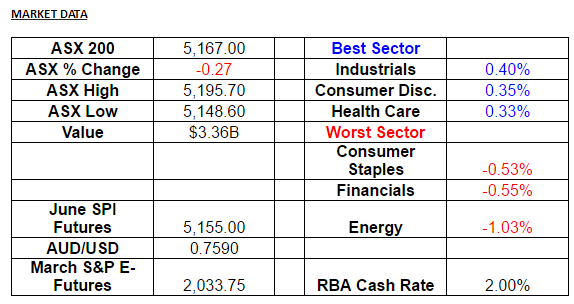

Market Data

KISS “Keep it simple stupid” over the next few weeks, there are 3 events unfolding that are likely to dictate equities movements / activity.

Time to keep our finger well & truly on the pulse

- The ASX 200 ended the trading week on a very quiet and dull note with the market closing up 15 points (+0.3%) to 5,183. For the week it closed up 17 points (+0.3%).

- 3 of the big 4 banks closed higher, with WBC being the weakest link ending its day off only 1c to $32.68, while CBA rallied 1% to $78.16.

- The Resource sector outperformed the broader market, with BHP rallying 4.7% higher to $18.10, while RIO closed 1% higher at $44.15 after announcing copper executive, Jean-Sebastien Jacques as CEO to succeed Sam Walsh.

- Treasury Wines Estate (TWE) lost 3.9% to $9.13, following a broker note cutting its outperform stance to neutral.

* Please watch out for the weekend report.

Resources have become exciting and scary – fingers MUST be on the pulse.

- A volatile session was experienced this morning as expected, with the broader market selling off as low as 5,119, only to climb back and rally 49 points (+1%) to 5,168.

- The major banks provided some assistance with the broader market’s strength. Commonwealth Bank (CBA) closed $1.34 (+1.8%) at $77.38.

- Fortescue Metals (FMG) roared 9.1% higher to $2.65, while BHP closed 2.4% higher to $17.29.

- The Gold sector rallied as expected, Newcrest (NCM) closed 6.5% higher to $17.67, while the recently battered, Regis Resources (RRL) closed 3.5% higher at $2.36. Market Matters bought a gold name today as mentioned live to Subscribers.

- On corporate earnings, retailer : Myer (MYR) surprised investors to the upside with their half year result, rallying 12.7% to $1.24.

Best Sector – Energy

Worst Sector – Telcos

No rate rise in the US, is it time to buy gold stocks?

- Another dull day experienced in the ASX200 today, with the broader market ending its day only 8 points higher to 5,119, as investors sit and wait for comments from US Fed Chairwoman tonight.

- Though the ‘big four banks’ somewhat helped the broader market close higher, with NAB the strongest of all, ending its day up $0.29 (+1%) at $28.08

- As expected, the miners underperformed – FMG lost $0.11 to $2.43, while RIO closed 28c lower (-0.7%) at $42.69.

Best Sector – IT

Worst Sector – Consumer Staples

Good morning everyone Overview Yesterday the local market fell 74 points, grinding lower all day, when other major equity markets were relatively quiet ahead of the Federal Reserves’ interest rate announcement. There was no stand out weakness except the weak energy sector and it simply felt like the market was “too long” and needed to square up. Over the past few weeks we have been observing how the ASX200 is following the $A in a risk-on / risk-off manner and, as many would have seen, the $A pulled back yesterday with the price of commodities. Market Matters has anticipated a rest / pullback from equities around this period; we actually believe the ASX200 is a trading buy into weakness under 5100 with stops under 5025. We would not be surprised to see a pullback in US equities after the Fed’s decision that we follow, but outperform.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.