Month: March 2016

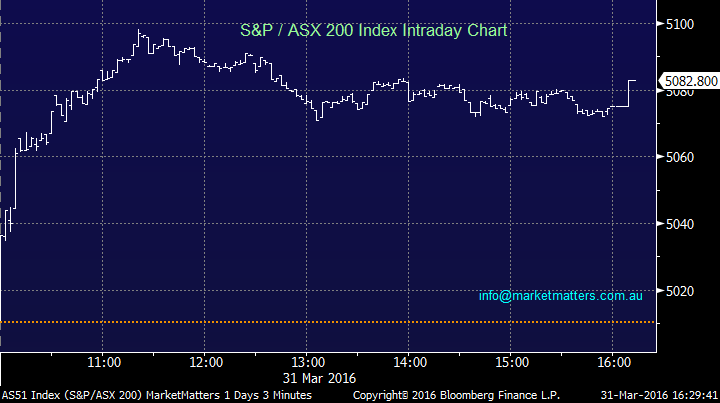

End of month – end of quarter – volatility reigned supreme Good Morning everyone Overview The last day of the month and last day of the quarter is here – and what a start to 2016 it has been. Volatility has reigned supreme in global markets with only one major global index (still with one day to go) in the black. Of course, that’s the S&P 500 in the US which has been supported by a very ‘accommodative’ central bank. If we look at the German DAX, French CAC and UK FTSE it’s also obvious that central bank support from the ECB has helped to support those markets….. On the flip side, Asian markets have been soft and we’ve been caught up to a large degree in that weakness.

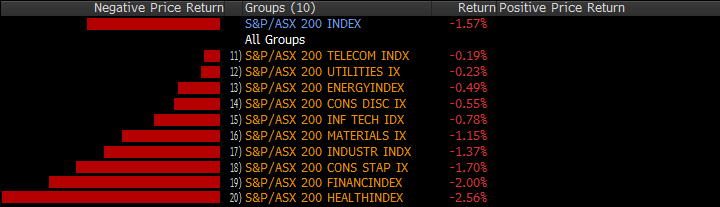

Australia – resumes its role as the ugly duckling – which is unfair (& sad!)

Good afternoon everyone

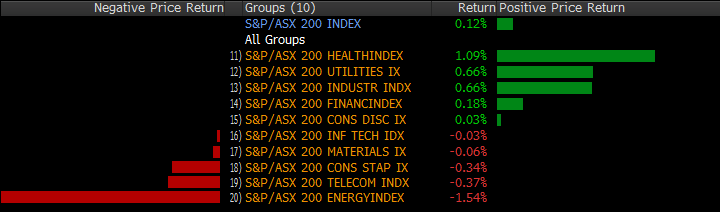

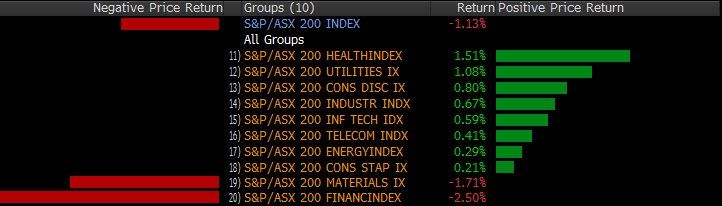

Why the banks are so important to the Aussie Market

If we’re being honest with ourselves, the world isn’t doing great. There are many obvious imbalances between asset pricing, the uncertainties and unpredictability of Quantitative Easing and how that will eventually play out, the outlook for currencies in an environment of massive central bank intervention, commodity prices – which are heavily linked to currency moves as discussed yesterday and obviously corporate earnings – which in the longer term drive share prices.

Good afternoon everyone

Sentiment has turned very bullish towards Gold, and prices have run up from a 12 month low of $1050 in December 2015 to a high on the 12th March 2016 of $1287. Gold currently sits at $1248 – up $4 overnight. We look at three elements worth considering when looking at the Gold price

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.