Month: July 2015

• The ASX200 had a quiet, yet positive session today, edging 20 points higher (+0.4%) at 5,689 and 2.2% higher for the week.

Happy Friday all, sorry about the delayed report this morning.

• The ASX200 continued its positive run for the week, with the session ending 45 points higher (+0.8%) at 5,669.

• It was a pleasant, yet quiet day, with the Major Iron Ore players contributing in today’s strength. BHP Billiton (BHP) and RIO Tinto (RIO) rallied 2.4% at $26.50 and $53.00 respectively, whilst Fortescue Metals (FMG) closed 1% higher at $1.89.

• The Health Care sector experienced quite the opposite, with CSL losing 1.4% at $96.35 and Resmed (RMD) down 1.6% at $7.52.

The Fed Signals Rate Rises are Approaching and Markets Remain Relaxed

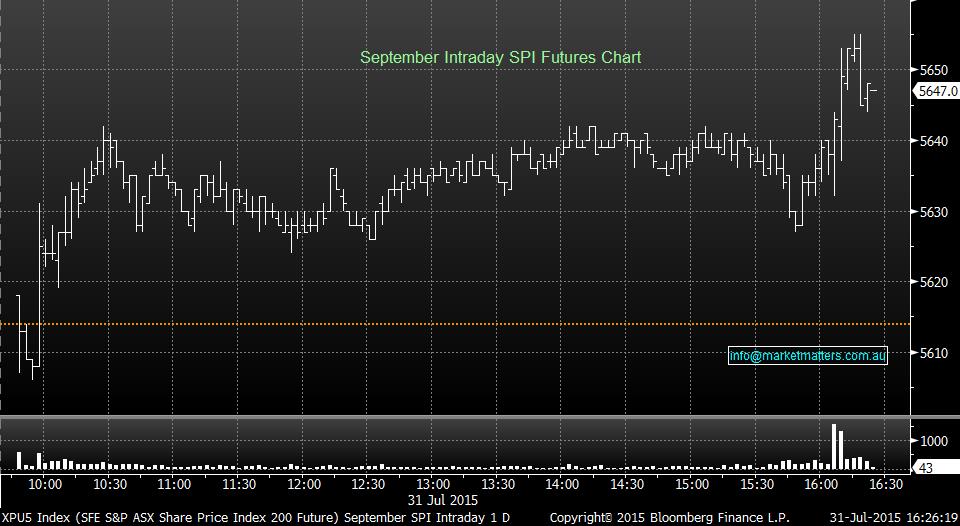

• It felt like a sombre and quiet day in Australia, however the rally unnoticeably continued in the ASX 200 today, trading as high as 5,650 in the morning and ending its session up 47 points (+0.7%) at 5,624.

• The Resource sector was seen as the strongest link in the market today. BHP Billiton (BHP) roared 2.1% higher at $25.89 and Fortescue Metals (FMG), a stock we currently own via call options, rallied 7.4% at $1.88.

• ‘Black Gold’, Oil Sector also experienced a positive day, Woodside Petroleum (WPL) closed 1.5% higher at $34.95.

• Financial Services, AMP Group closed 2% higher at $6.52 after it followed some of the recent banks’ suit and stated it won’t accept new investor property loans as well as raise its interest rates on its investor property loan holders.

With our positions growing and the market remaining volatile, we believe it’s extremely important to keep our fingers on the pulse with a special thought to what comes next.

• The ASX 200 followed global equities’ sentiment from overnight and traded on its lows early this morning, as low as 59 points, until the Chinese Government reiterated its intention to support its market helping our domestic market to claw back most of its losses and close only 5 points lower from previous at 5584.

• The banking sector closed mixed, with Westpac (WBC) being the weakest link, down 0.4% at $34.21 after reports of a computer glitch not allowing to charge different interest rates to its owner occupier customers and its property investors, losing an estimated cost of ~$1m a day.

• Origin Energy (ORG) rallied 2.7% higher after announcing its LNG project is on track with its current export target. ORG closed 30c higher at $11.45.

• Today, subscribers received a live alert reducing half of one of our current holdings, into the energy sector.

When I witness an 8.5% plunge in Chinese equities (Chart 1) for no major reason, it actually makes us feel lucky to be primarily investing in the serial underperforming Australian Index. The local benchmark for us is Commonwealth Bank (CBA). Our largest stock currently pays a ~4.6% fully franked dividend and if you purchase today, you will receive ~7% fully franked over the next 13 months, very attractive compared a term deposits around 2% unfranked. With a little acute market timing, these rates of return can be improved further. We purchased CBA under $81 a few weeks ago and its now trading pleasantly over $86. Hence, we are looking for returns better than CBA is offering for us to consider purchasing outside this simple and relatively safe space.

• A soft start was experienced in the ASX 200 today, trading on its lows early in the morning at 5538, only to recover and close 24 points (+0.4%) higher at 5590.

Home Loan Rates are Rising as Official RBA Rates are Falling

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.