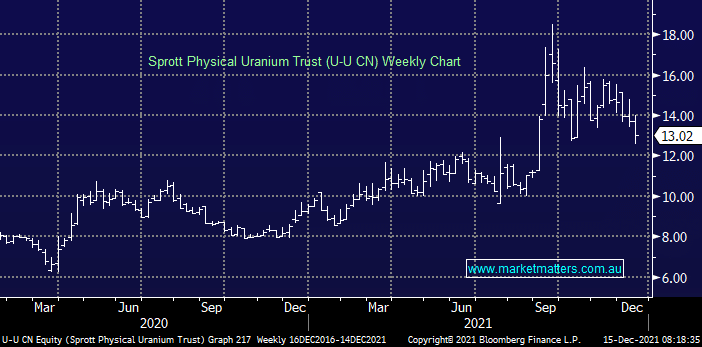

The Sprott Physical Uranium Trust is now trading at what we estimate to be around ~6% discount to the value of it’s Uranium assets which, from what we can tell is the largest discount it has traded at. We are bullish this volatile commodity and we intend to use weakness to add to our position, funded by selling our 5% holding in the ACDC ETF (ACDC), a move we have flagged a few times but have been patiently watching over the last few weeks.

scroll

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

Close

Close

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Close

Close

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Close

Close

MM likes the U-U CN ETF at current levels

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

PULSE CHECK WEBINAR: Portfolio positioning towards FY26

FY26 is shaping up as a year where strategic portfolio positioning will matter more than ever. Hear from James Gerrish & Shawn Hickman as they detail MM's current views.

Podcast

LISTEN

Tuesday 3rd June – ASX +29pts, IEL, 360, TWE

Daily Podcast Direct from the Desk

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Podcast

LISTEN

Tuesday 3rd June – Dow up +35pts, SPI up +69pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.