When you need bathroom fittings & fixtures, chances are you’ll at least drift through a Reece showroom. This $11bn business generates around half its revenue in the US following its acquisition of MORSCO in 2018 which more than doubled their size in one fell swoop. While the Australian business still accounts for a disproportionally high percentage of the profits given its market dominance, the US is where a large share of future growth will come from, and the recent result in February showed that was the case.

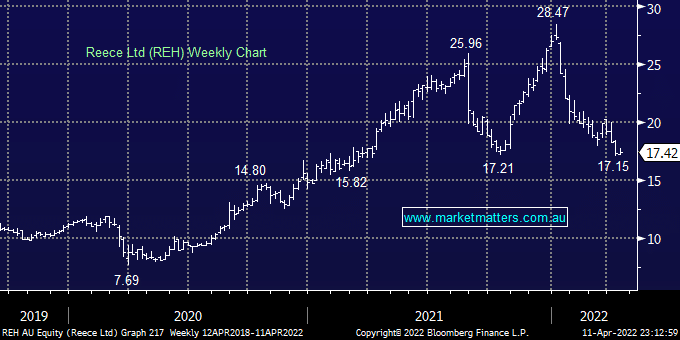

The key however is cost pressures and relative valuation. REH is growing strongly however costs are rising which is putting pressure on margins. They’ve also had to carry higher stock to mitigate supply chain issues and this has dragged on cash flow. The other obvious issue is valuation. On 30x, REH is cheaper than it once was, but not cheap enough for the headwinds still facing them in the near term.