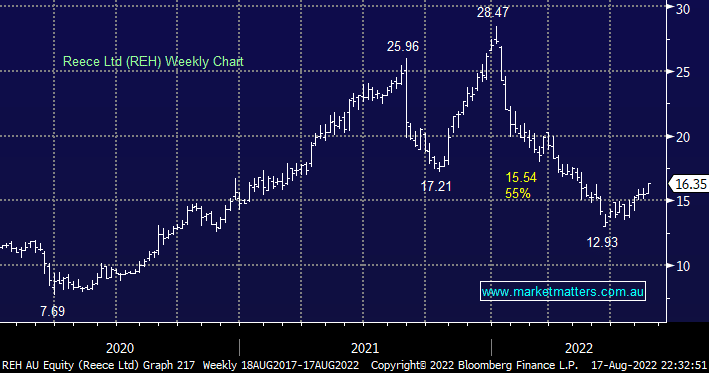

Plumbing business REH was a favourite of many fund managers in 2021 but it caught many off-guard with its sharp correction over the last 14 months, yesterday it rallied +3.6% as it gains some traction in anticipation of next Tuesday’s FY22 result. We will need to see a catalyst for us to consider REH for one of MM’s portfolios into Christmas but never say never into a company report.

- In April we saw no reason to own REH ~$17.50 and with the stock still commanding an Est P/E of 28.9x for 2022 it’s still not cheap enough for us.

NB Technically the stock looks constructive while it can hold above $15.50 especially with investors searching out perceived “bargains”.