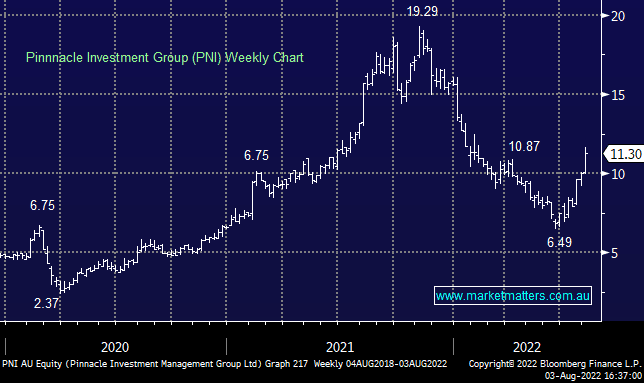

PNI +12.21%: Released FY22 earnings today were a whisker below consensus expectations at the profit line, printing $76.4m versus $77.4m expected while the 17.5c dividend was a touch above. They talked to a strong 1H in terms of flows and a weak 2H which is understandable, with Funds Under Management (FUM) down overall for the year, the first time since FY12. The fall in FUM came from market weakness and the mix of FUM inflows actually helped margins given a skew towards retail money. Additionally, Pinnacle managed their cost base well, showing flexibility in volatile markets while still driving investment inflows which led to profit growth of 14% in the year despite the fall in FUM. The company still has around $120m of investible dry powder to continue to expand their footprint while the market only had very tepid growth pencilled in for FY23 – so upgrades here are likely.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

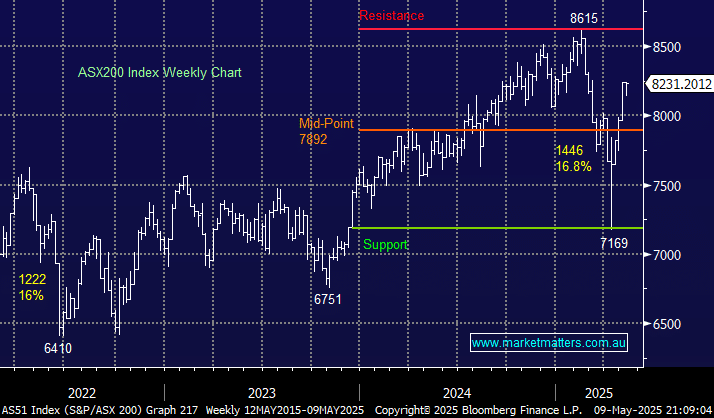

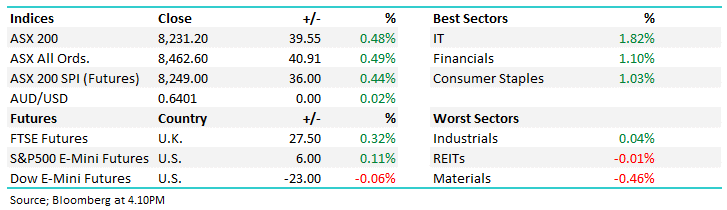

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains long and bullish PNI in the Emerging Companies Portfolio

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on PNI

MM, why the negative view on PNI?

Thoughts on Fund Manager sentiment and PNI?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.