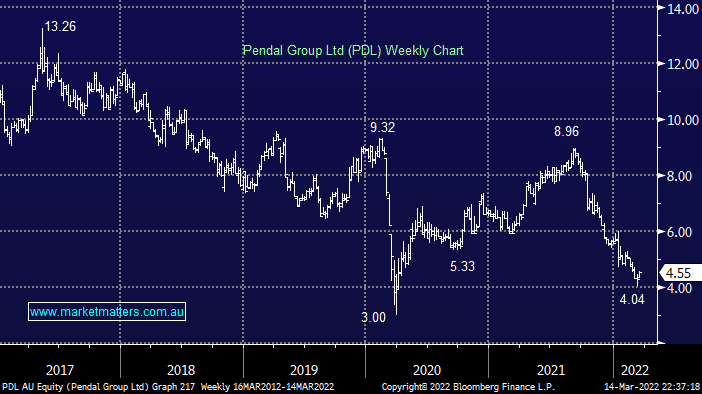

PDL has been on a slippery slope for years but the last 6-months has seen the stock more than halve when the ASX200 only corrected 11.5% at its absolute worst. The Sydney based investment firm is trading on a PE under 9x but it still feels like the downside momentum will ultimately win out and any bounces while probably sharp will be relatively short-lived. It feels like the appealing estimated yield above 9% could prove a classic “yield trap” as it has with MFG – a sample of questions MM has received over recent months proves testament to this fact perfectly.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM is neutral PDL

Add To Hit List

Related Q&A

Thoughts on PPL’s takeover of PDL?

Why is Pendal (PDL) falling after PPT’s bid?

Is MM still happy with its PDL recommendation?

Clarifying MM thoughts on Pendal (PDL)

MM views on PDL

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.