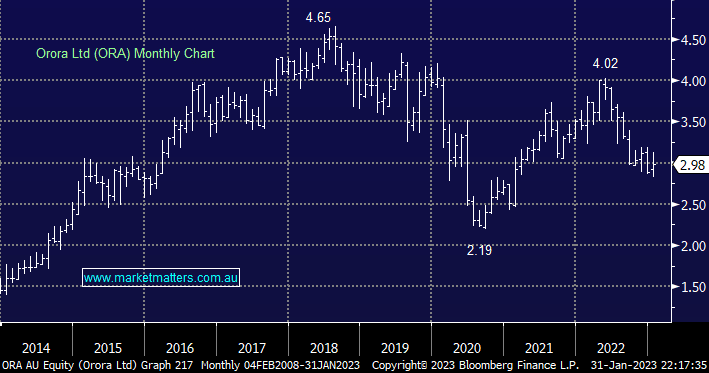

As we’ve mentioned multiple times in recent reports, we think there is an opportunity for depressed stocks that have lagged the recent rally to play some performance catchup if their results are simply ‘not too bad’ during this upcoming reporting season. One company that has struggled over recent years is the packaging business, Orora (ORA), trading down from a $4 high in April this year to just below $3 now. Back in 2019, they generated earnings of $221.5m and were priced on a multiple of 19x those earnings. As you can imagine, 2020 was a tough year and they’ve been recovering incrementally since then, producing $187m profit in FY22 and are tipped to do $190m in FY23.

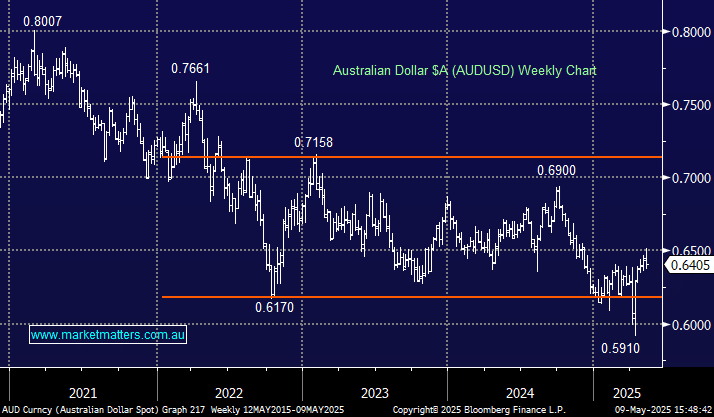

This is not a high-growth business and there are some key variables that impact earnings – currency being one of them (73% of their earnings are from the US), however, as we look for more defensive, value-orientated companies that have been sold down on expectations of a looming global recession that may or may not eventuate, with decent dividends and not a lot of upside built in, ORA was high on the list.

Trading on an Est PE of 13x (about 20% ‘cheap’ versus its 5-year average) with a projected (unfranked) yield of 6.2%, ORA is being added to our Income Portfolio Hitlist, with their 1H results due on the 16th Feb.