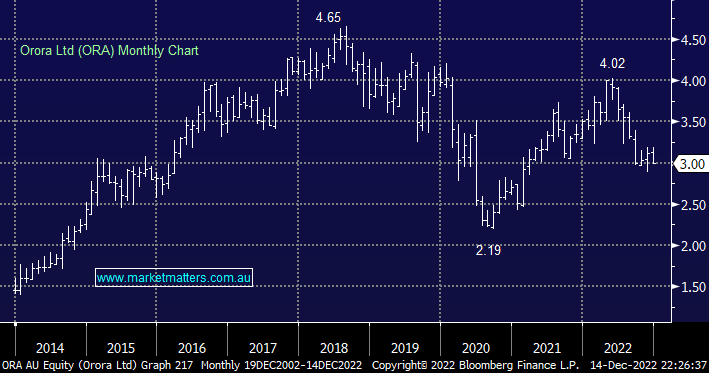

Packaging business ORA has fallen -14% year-to-date and it now looks reasonable value trading on an Est P/E of 13.5x for 2023 plus its 6.2% projected unfranked yield is a useful top-up for performance. The company is growing in North America and sustainability trends are aiding demand for ORA’s cans and fibre packaging solutions, while it stays ahead of the curve in this department things look solid for ORA.

- We believe ORA is interesting as a yield play but don’t feel its overly compelling value at current levels.