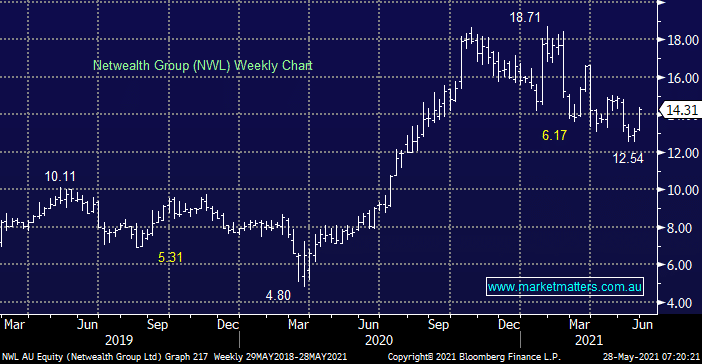

Investment platform provider NWL has struggled through 2021 after their interest margins on deposits took a hit which worried investors that it could ultimately impact funds under administration (FUA). However as bond yields signal that the RBA is likely to start hiking rates in the not too distant future NWL might find itself in an improved position and the more than 30% pullback is certainly improving the risk / reward, plus we should remember that NWL is debt free with a strong financial backdrop. NWL is a larger investment platform than both HUB 24 (HUB) which we currently hold in the Flagship Growth Portfolio and Praemium (PPS) which is held in the Emerging Companies portfolio. As we have written in the past, we are positive on the independent platform space as they take market share from the incumbent’s.

scroll

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM likes NWL around $14 with ~7% stops

Add To Hit List

Related Q&A

NWL, ARB, HUB

Your current view on NWL would be appreciated

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.