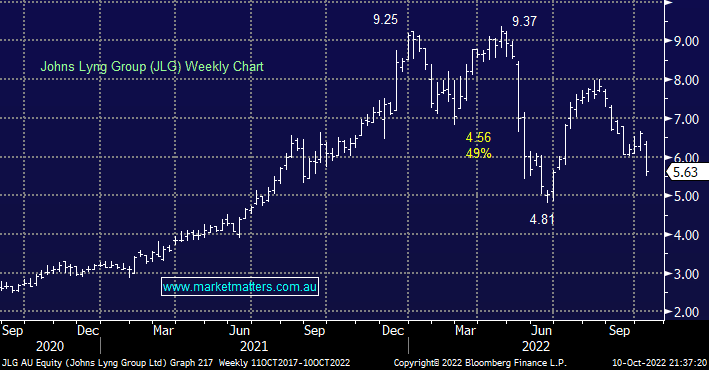

As we mentioned in yesterday’s Match Out Report Johns Lyng Group (JLG) fell almost -15% on Monday after their influential CEO sold 7.5% of his holding to fund a new house in Colorado and tax liabilities. Unfortunately they also reconfirmed FY23 revenue & EBITDA guidance which was around 5% below market expectations – i.e. an awful combination of insider selling shares after delivering soft guidance. The CEO and COO actually started selling shares in May although we would add that both directors retain significant holdings in the business it’s a clear worry when their happy to sell down after the stocks fallen almost 40% in price.

- In September we said that JLG trading around $6 was too expensive trading on an Est P/E for 2023 of over 30x for the type of business that it is, nothing changed even after yesterday’s tumble.