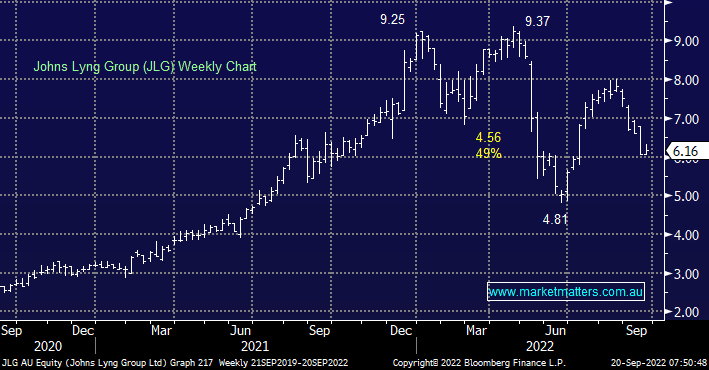

JLG is a Victorian-based non-residential construction business that was looking good earlier in the year but this $1.6bn business has subsequently been hammered since the CEO and COO started selling shares in May although we would add that both directors retain significant holdings in the business.

- We liked JLG headline numbers in August with revenue coming in close to $900mn which delivered after-tax profits of $38.5mn, however, we think it’s too expensive for the type of business that it is, and is over-owned by Australian fund managers.