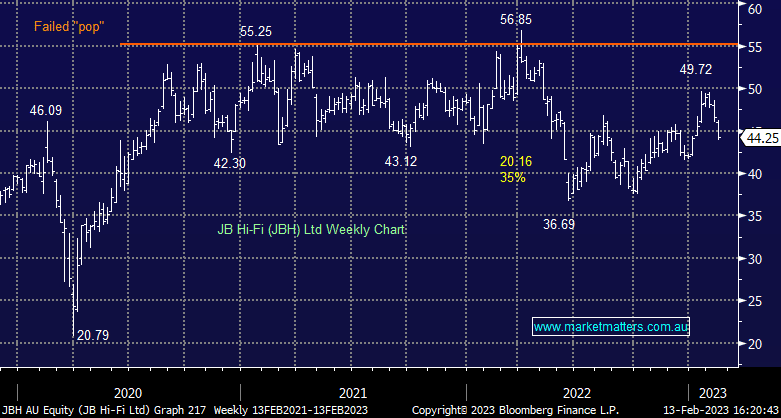

JBH -5.08%: traded lower following 1H23 results that were largely pre-guided to, with commentary around January trading the main focus. To that end they said while the group is pleased with January trading result, with sales continuing to be well above pre-Covid January 2020, we have seen sales growth start to moderate from the elevated levels seen in 1H. This is what the market has latched on to and is another data point signalling a slowdown in consumption. Metrics for 1H23 were strong, earnings +15% YoY and an interim dividend of $1.970 vs. $1.630 this time last year, however, the stock market is forward-looking and the outlook is for weaker growth, lower margins and a tougher environment ahead – we don’t see any reason to own this right now.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral/bearish JBH ~ $45

Add To Hit List

Related Q&A

Highest conviction calls after this weeks pullback

JBH powering along

Do you like Nick Scali (NCK) and retail into 2024?

Would MM buy Lovisa (LOV) at current levels?

MM thoughts on JB HI FI

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.