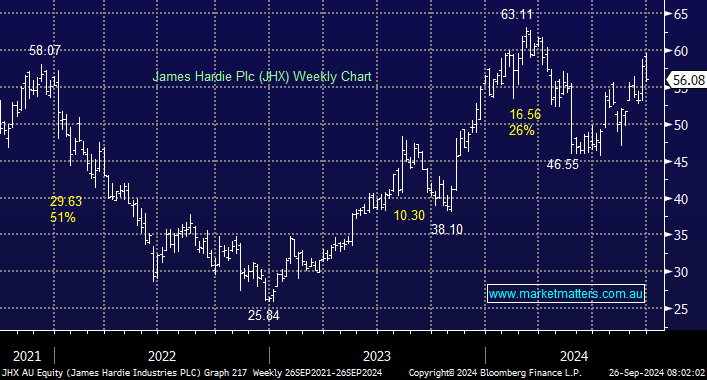

JHX is well-positioned to benefit from increased construction activity, both renovations and new builds, in the US and Australia. We’ve said for a while that JHX is an FY26 recovery story, but assuming central banks can stave off recessions, it looks exciting, and with tailwinds gathering for JHX, we can see a test of $65 into 2025.

Our only concern is the correlated US Homebuilders have already surged ~30% since May, and a pullback wouldn’t surprise us as we see a classic case of “buy on rumour, sell on fact” post the Feds outsize 0.5% rate cut. Hence, we have been patient in adding JHX to our Hitlist, but it’s most definitely on our radar.

- We like JHX moving forward, and it could easily find itself in our Active Growth Portfolio by Christmas.