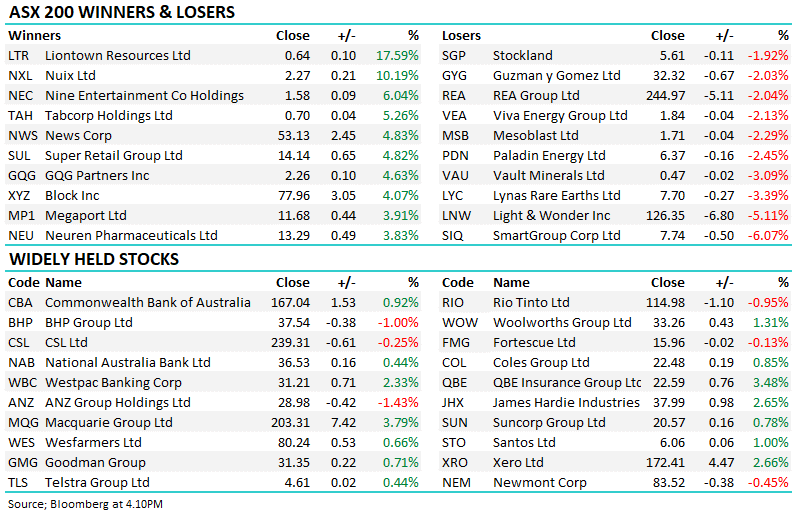

JHX +13.76%: the building products company posted an inline 2Q update today, though shares surged to 2-month highs on strong guidance. NPAT of $US179m was as expected, EBIT was a small miss at $US240m mostly on R&D and corporate costs but margins were strong thanks to successful cost control elsewhere. The company said 3Q earnings were expected to come in at $US165-185m, a huge $US40m beat to consensus driven by market share gains and higher margins. James Hardie has worked on reducing input costs, helped by falling freight costs, which is driving operational leverage. If this run rate can continue through the rest of the year, JHX could produce FY24 NPAT ~10% ahead of consensus expectations. Shareholders also enjoyed the new $US250m buyback – a top update overall and shows the business is accelerating.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

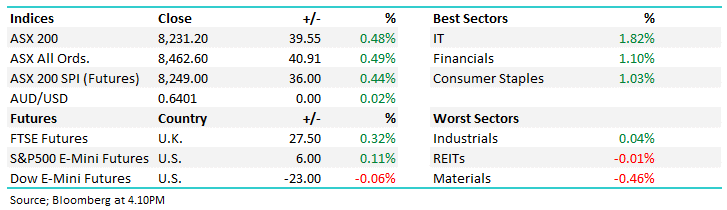

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish JHX

Add To Hit List

In these Portfolios

Related Q&A

James Hardie (JHX), Car Group (CAR) and HUB24 (HUB)

James Hardie (JHX)

JHX

Is JHX a buy today or should we wait?

What Building stocks does MM like today?

What’s MM’s favourite 5 stocks for short term bull run?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.