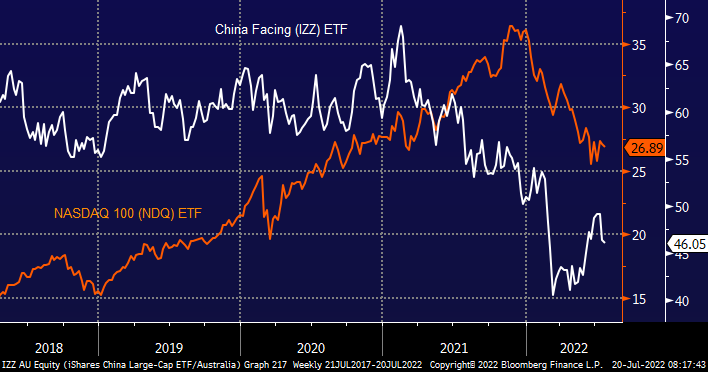

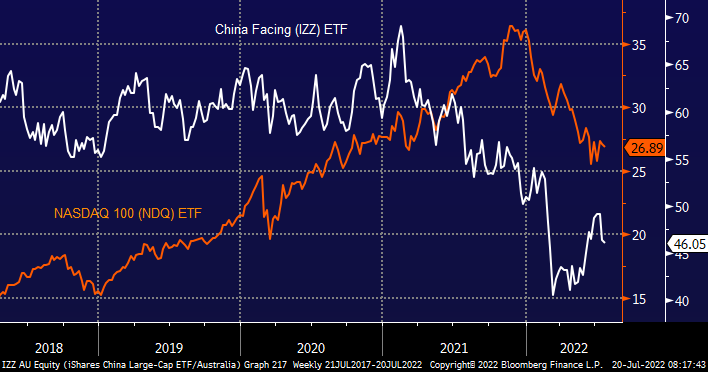

While we’ve all been focused on the recent weakness across local and US indices the fall by Chinas market has been even larger. i.e. the ASX has fallen -16% from its April high and the NASDAQ -33% from its Novemvber’21 high whereas China’s Shenzhen CSI 300 Index has fallen 37% from its early February 2021 high. In simple terms the Chinese market topped first and fell the hardest, we now believe in typical market fashion it will find a low first and rally the hardest.

- Fundamentally it feels like China is at or close to its nadir e.g. we’ve seen a property crash led by Evergrande, ongoing disruptive government restrictions on businesses, economic contraction and a very slow almost backward attitude to moving on from Covid but when things look there worse opportunities often present themselves.