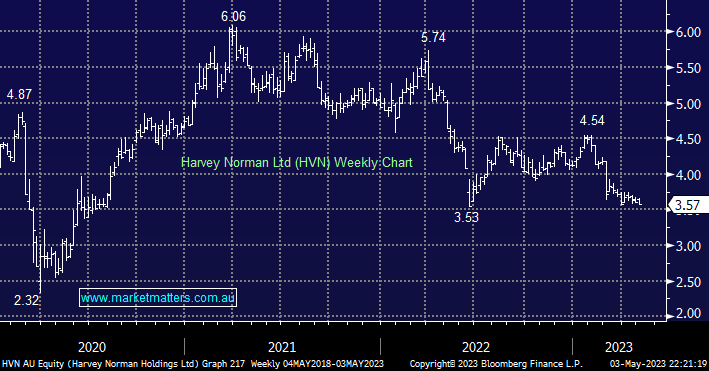

HVN has endured a tough few years seeing the stock fall over 40% not helped by a disappointing 1H result in February where earnings (ex-property revaluations) were a ~10% miss, coming in at $416m, also margins were under pressure as costs weighed. The outlook is also a major concern with the first 7-weeks of 2023 seeing Australian franchisee sales down 10% on a like-for-like basis as consumers move away from bulky white goods and furniture purchases – we saw this theme continue to play out in the Good-Guys update yesterday from JBH. With the RBA keeping its foot firmly on the Australian consumer through higher interest rates we see no reason to buck this trend as people tighten their belts.

- We can see HVN breaking under its 2022 low over the coming weeks/months.