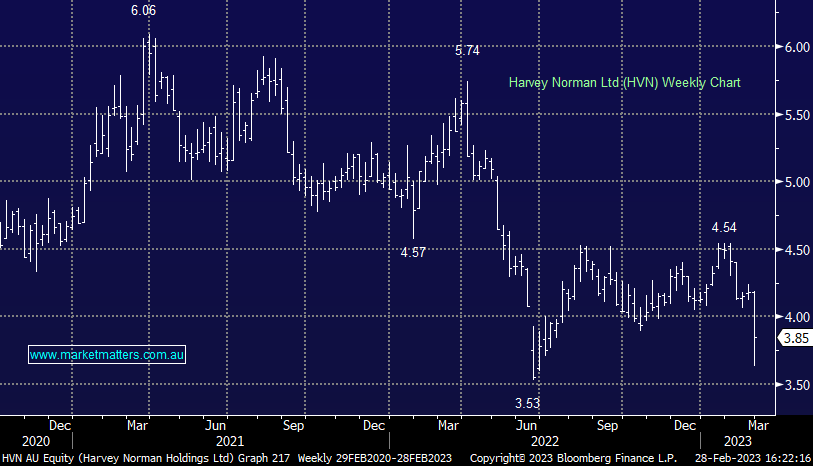

HVN -7.45%: the retailer fell to 6-month lows and was the worst performer on the ASX200 today after a disappointing 1H result. Revenue was in line with expectations at $2.3b, however, earnings (ex-property revaluations) were a ~10% miss, coming in at $416m. margins were under pressure as costs weighed, PBT margins in their Australian franchise business fell from 8.5% in 1H22 to 6.8% in today’s announcement. The outlook is also a concern with the first 7-weeks of the new year seeing Australian franchisee sales down 10% on a like-for-like basis as consumers move away from bulky whitegoods and furniture purchases.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral/bearish HVN

Add To Hit List

Related Q&A

How does MM view retail and other sectors being sold off?

What does MM think of Harvey Normans (HVN) has significant property assets?

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.