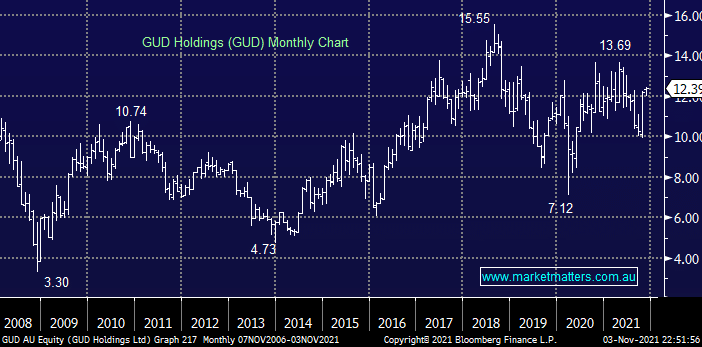

Industrial products manufacturer GUD sprang back to life in October following a trading update which included confirmation that demand for its products, which include aftermarket auto parts & water products had remained firm through COVID lockdowns. The stocks trading on a reasonable valuation and its reliable yield of more than 5% fully franked is extremely attractive even as interest rate hikes are forecast moving forward – we can easily see 20% upside in line with current positive momentum.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM is bullish GUD

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.