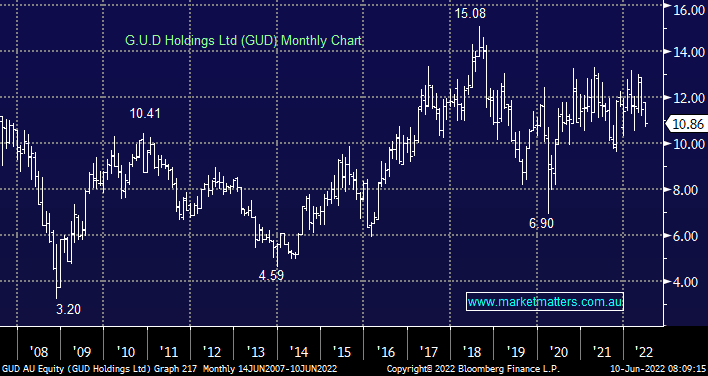

G.U.D manufactures industrial goods such as electrical appliances, auto parts and water systems hence it benefits from high levels of discretionary spending which is not the case today hence the obvious question being why have UBS included it in their list. The company has coped extremely well with supply chain / China disruptions with elevated inventories helping insulate the business, UBS believe the stocks valuation is attractive but MM is more comfortable around $10 where the projected yield will be well above 4% and P/E sub 14x.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM likes GUD ~$10

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.