What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

China has pulled more stimulus levers over the last few days, and although they are targeted, as was previously flagged by Beijing, it does feel like Xi Jinping has drawn a line in the sand after recent economic data signalled the need for urgent action. The property sector, once an integral driver of economic growth, is still struggling with prices for new homes across 70 cities having declined for the last ten consecutive months after falling 0.6% in April, with property investment down a whopping -9.8% in the 1st four months of 2024 compared to last year. April’s fall represents the fastest month-on-month rate of decline in more than nine years, although interestingly, real estate stocks are starting to bounce.

- China’s Ministry of Finance is selling $138 billion of ultra-long special sovereign bonds to provide more policy support to spur ailing credit demand in the world’s second-largest economy.

- On Friday, Industrial production rose by 6.7%, beating expectations of 5.5%, a marked pick-up from the 4.5% in March.

- However, the retail sales increase of 2.3% missed the +3.8 % forecast, and fixed asset investment rose by 4.2% for the first four months of the year, lower than the 4.6% expected increase.

China has set a target of ~5% GDP growth, which many analysts believe is ambitious, but if stimulus picks up from here and they can arrest the plunging property market, it is not impossible with Xi Jinping not having to worry about annoying/petty things like elections. There’s been a drumbeat of pro-growth signals from China in recent weeks, with some important measures being announced over the last few days to support the beleaguered property market:

- Xi Jinping has relaxed mortgage rules, including lower deposit requirements and has urged local governments to buy unsold homes aided by $42bn of central bank funding and then convert them into affordable housing.

On Friday, China developer shares surged ~10% following the news and perception that Beijing has started to turn the stimulus dial. At this stage, it’s arguably just a fraction of what’s required to address the property supply-demand mismatch, but they had to start somewhere, and we wouldn’t be betting against Beijing now that they have set out on a path to reinvigorate their economy. We believe this is the start of the next phase for China, seven years after Xi Jinping said, “Houses are for living in, not for speculation” – another great example of why investors shouldn’t argue with Beijing; they wanted to crush property speculation, and they did just that.

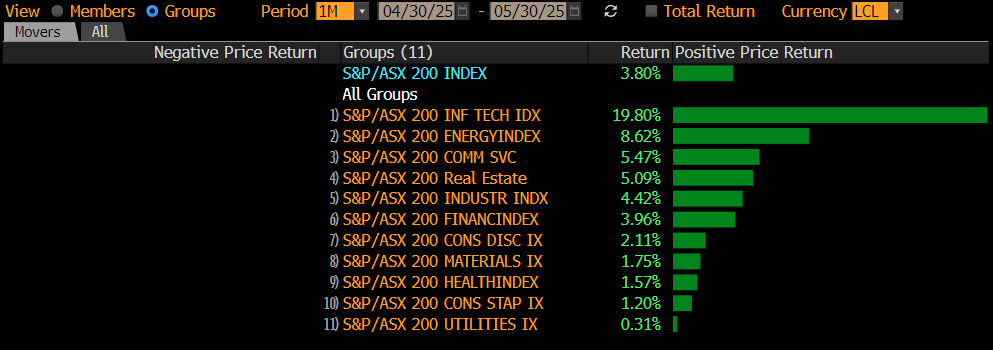

Chinese stocks have bounced over 18% from their 2024 low, and we see further upside primarily due to stimulus levers being pulled by Xi Jinping et al. Fund managers are their most bullish towards global stocks in three years, and China is slowly joining the party, having reached an 8-month sentiment high on hopes of an economic turnaround albeit from an extremely low bearish base, i.e. short Chinese equities are still the second most crowded trade. Although Japan is still the preferred market in the region, unfortunately, Thailand, Indonesia, and Australia are among the markets where global fund managers are least bullish.

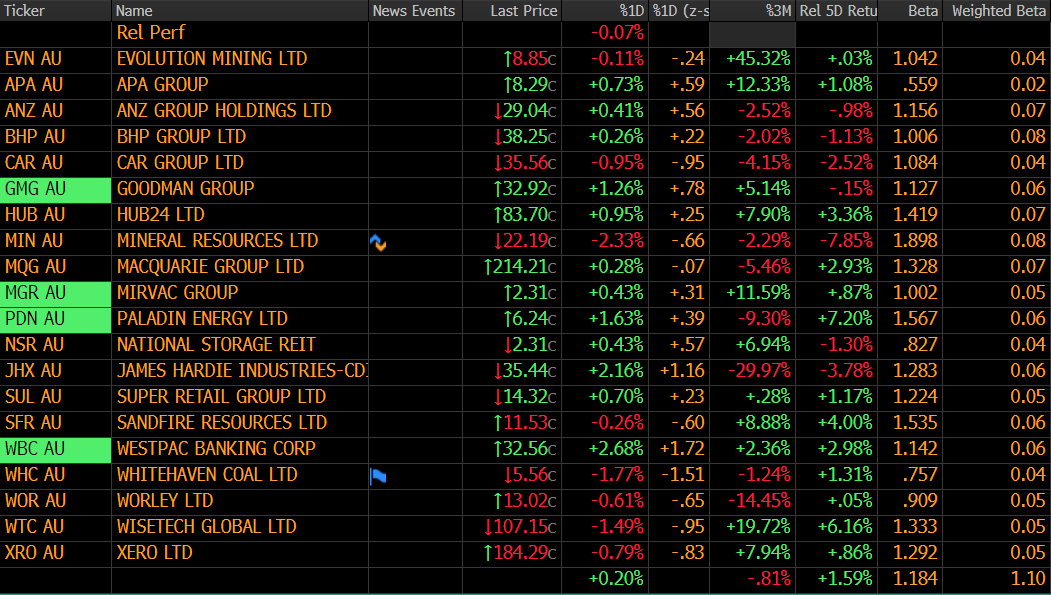

- We expect the Shenzhen CSI300 Index to initially test ~15% higher—a great read-through for Australian miners.