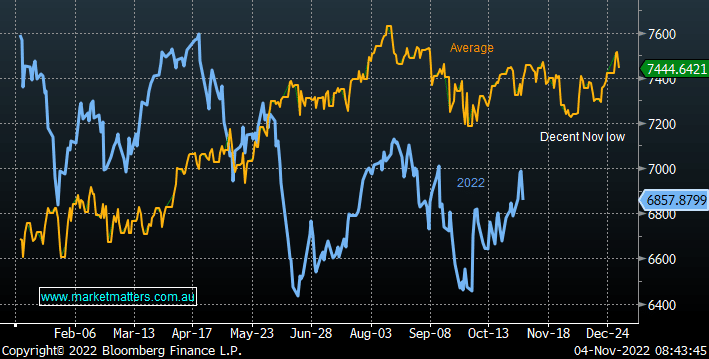

Thursday saw the ASX200 get clobbered by the Feds sledgehammer, the index finally closed down -1.8% even after bouncing over 40-points from its intra-day low. The selling was broad-based with almost 90% of the market closing in negative territory as the recent buyers retreated into the shadows following the net hawkish rhetoric from Jerome Powell. However, we believe investors shouldn’t be too alarmed, as we touched on yesterday weakness is common in the 1st half of November.

- Over the last 20 years, the ASX200 has consistently fallen in the 1st half of November, and considering how far we’ve rallied over the last 4 weeks more on the downside wouldn’t surprise.

- Buying this weakness and holding for around 6 weeks has produced some stellar returns for the followers of short trend swings – when markets follow strong rhythms we see no reason to fight the numbers.

At MM we believe statistics alone don’t give reason to move overweight equities but when they dovetail with our other analysis it does help our confidence when it comes to pressing the “buy button” in the face of falling prices.