The ASX 200 ended the week up 2.47% courtesy of the widely anticipated RBA rate cut and Michele Bullock’s not-so-widely-expected dovish rhetoric. Credit markets are now looking for an additional three rate cuts by Christmas or February’26 at the latest. Not surprisingly, the rate-sensitive names led the advance, with tech, real estate, and financial stocks adding the most points to the index, riding the RBA wave of optimism, although there were plenty of losers on the stock level, as the macro and economic news kept on flowing.

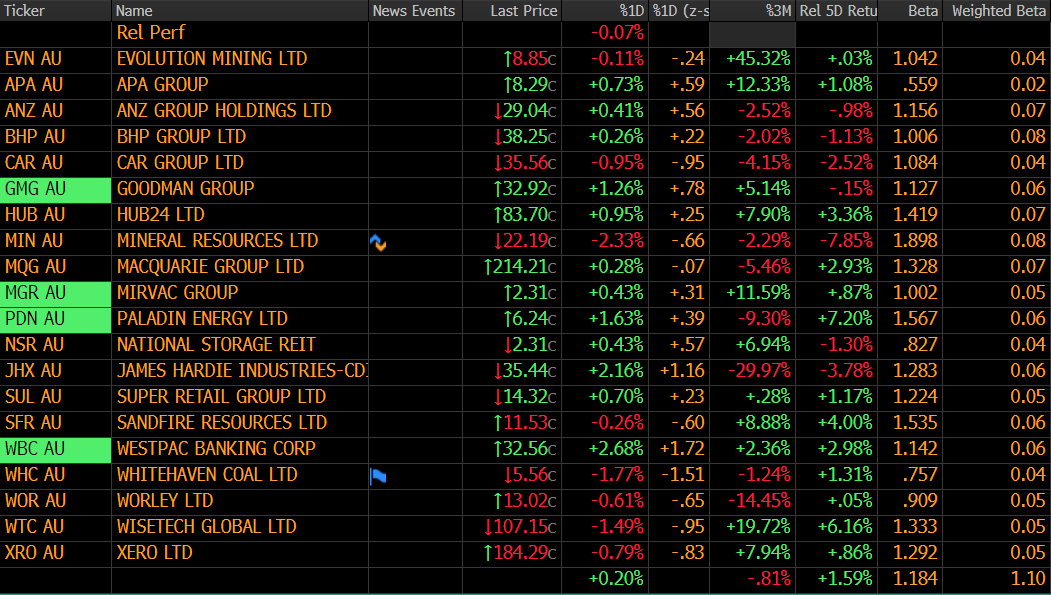

The winners and losers over the week were again a mixed bunch, with the “Certainty Trade” and golds faring well while iron ore and lithium stocks struggled:

Winners: Technology One (TNE) +16.7%, West African Resources (WAF) +16.7%, Evolution Mining (EVN) +11.4%, Regis Resources (RRL) +11%, Boss Energy (BOE) +7%, JB Hi-Fi (JBH) +5.7%, Charter Hall (CLW) +5.1%, Seek (SEK) +5%, and Commonwealth Bank (CBA) +2.5%.

Losers: Nufarm (NUF) -39%, Liontown (LTR) -22.1%, Pilbara (PLS) -11.5%, IDP Education (IEL) -10.7%, Mineral Resources (MIN) -9.6%, Zip (ZIP) -9.3%, Fortescue (FMG) -8.8%, HMC Capital (HMC) -8%, Healius (HLS) -9.7%, Reece Ltd (REH) -5.5%, and NEXTDC (NXT) -4%.

On the economic and geopolitical front, we received a trifecta of news which pushed the ASX200 higher but the US S&P 500 lower:

- The RBA adopted a far more dovish tone than was anticipated, propelling local bonds higher on rate cut hopes over the coming year as the ASX eyes the perfect “Goldilocks” scenario for stocks.

- A poor US bond auction combined with debt concerns as Trump 2.0 looks to spend heavily on tax cuts sent long-dated bond yields higher, weighing on equities.

- On Friday night, Trump again started banging the tariff drum, which will likely create renewed nervousness across equity markets early in the week.

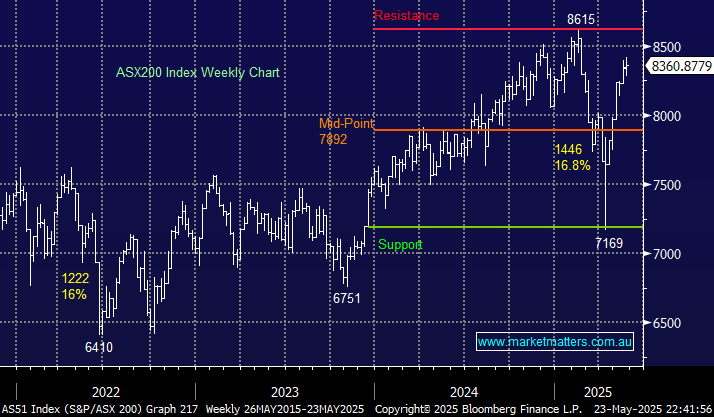

We continue to believe the ASX200 and other major global indices will follow the German DAX and Canadian TSX indices to post fresh all-time highs in 2025 with a “risk on” bias likely into Christmas:

- We anticipate that the ASX will rally through 2025 with its all-time high now only 3% away: what tariffs!

Overseas markets ended on a sour note as Trump dug in on his threat to impose a 50% tariff on the European Union and said a potential 25% charge on smartphones would apply to all foreign-made devices. This was the latest escalation of a trade war that worried markets, which had largely moved on from tariffs. The $US dollar slumped to its lowest level since 2023 on the news, sending gold up over $US60, but stocks pared losses as bonds held onto their gains after Scott Bessent said the US could strike large trade deals in the next couple of weeks.

- The SPI Futures are calling the ASX 200 to open down 0.4% on Monday, following the soft and volatile session on Wall Street.