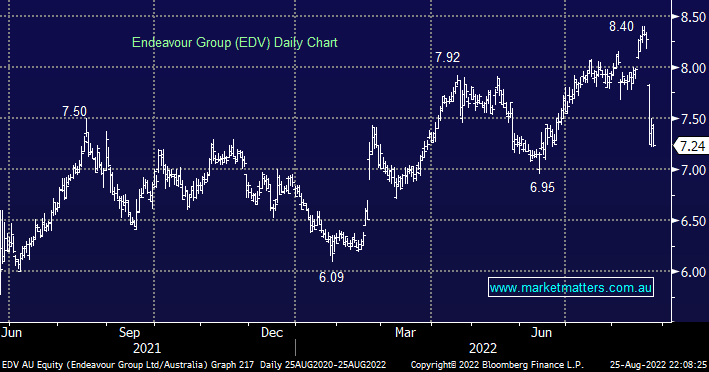

Lastly moving onto pub and bottle shop owner EDV who was smacked earlier in the week after delivering a mixed bag in its FY22 report – their hotel division is travelling well while their retail business is finding the road a bit tougher i.e. the impact of the rising cost of living has not yet occurred. The company guided to a tough 1H23 with additional cost inflation, a similar theme across the sector, as we said at the time not a lot to like in this result with EBIT margins on the retail business sitting at just 6.6%.

- We’re not fans of EDV after its poor result but believe a lot of the miss is already built into the share price.