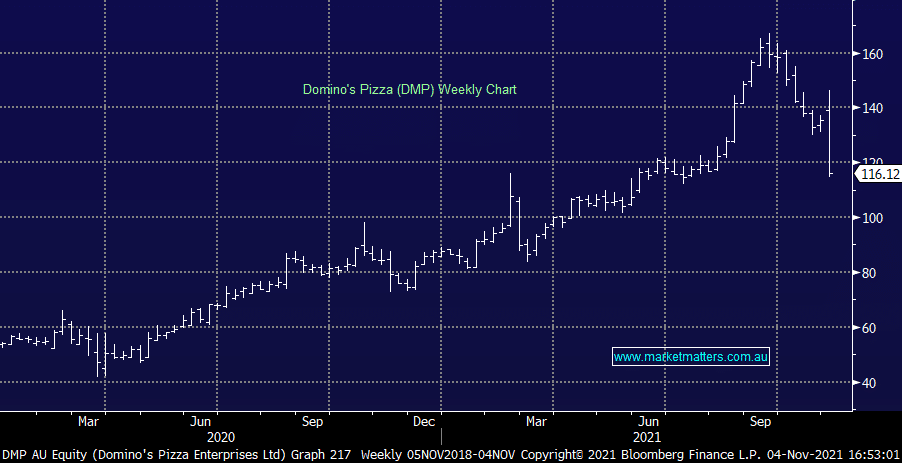

DMP -18.4%: The pizza maker got hit today after sighting inflationary pressures across the group along with weaker sales in their Japanese operation at their AGM today. Citi say that Domino’s cost pressures appear to be building due to the early onset of food cost inflation and the two-week closure of the highly profitable New Zealand market, and that puts their FY earnings at risk. When your stock is trading at a ~90% premium to the broader industrial sector, any sort of hiccup will be compounded by a big multiple re-rate. If we price DMP back on it’s average P/E for the past 5 years, i.e. take away the COVID bump to earnings and multiple expansion, DMP is worth ~$90, not the $116 it closed today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM has no interest in DMP at this stage

Add To Hit List

Related Q&A

DMP/CKF as possible growth/dividend stocks

DMP & Chemist Warehouse

Does MM like Dominos (DMP) capital raise?

Does MM like CKF &/or DMP?

What are MM’s thoughts on Domino Pizza?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.