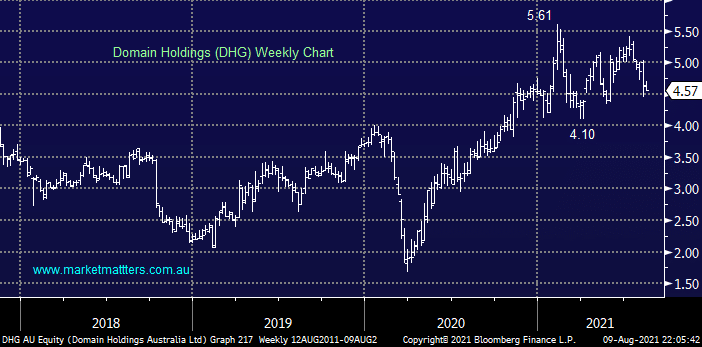

DHG has been suffering of late following REA Group’s (REA) strong FY21 result but disappointing guidance for the year ahead, in the case of REA their report showed an impressive +13% in revenue but listings for July fell 3% year on year which is not what you want to see for a company priced for growth. Lockdowns are clearly the issue here and hopefully these will be a distant memory by Christmas hence any ongoing weakness towards $4 feels like a great risk / reward buying opportunity in DHG.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Close

Close

Monday 30th June – Dow up +432pts, SPI up +5pts

Monday 30th June – Dow up +432pts, SPI up +5pts

Close

Close

MM is neutral / negative DHG short-term

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 30th June – Dow up +432pts, SPI up +5pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.