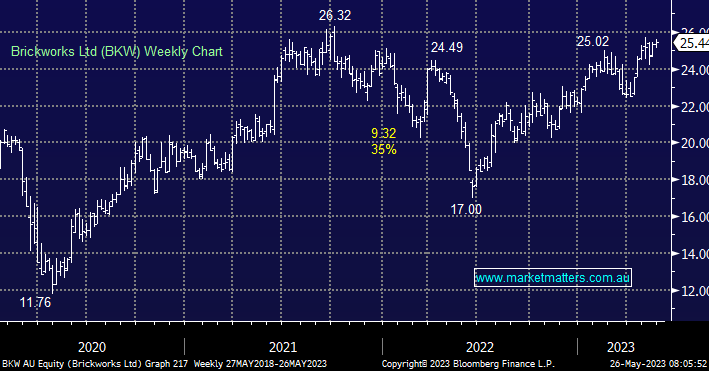

BKW delivered a broadly in-line result last quarter on the back of stronger-than-expected Property EBIT, although the biggest contributor to this was $113m in upward revaluations. Building products earnings are likely to face significant headwinds from FY24 (with BKW trying to hold price in the face of elevated input costs despite softer vols), property should fare better through the downturn with strong rental increases helping to offset cap rate headwinds.

- We like BKW medium term for a break above post-COVID highs but the risk/reward is unattractive above $25.