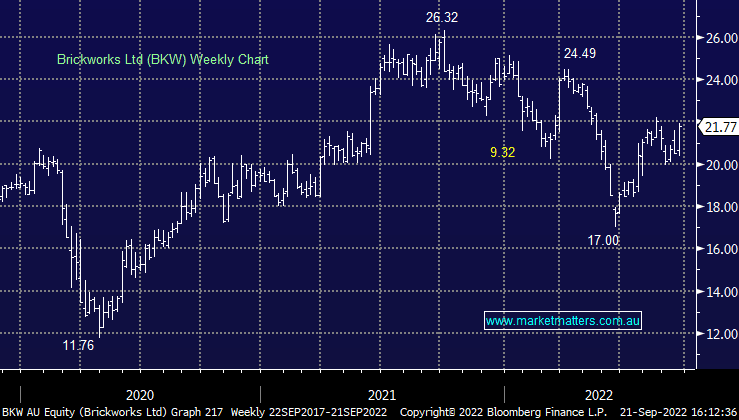

BKW +0.37%: the building products company saw surging growth in their FY22 result today, however, the company was very cautious on the outlook as interest rates pressure construction globally. EBIT from the building products divisions in Australia and North America saw total growth of more than 200% to $155m, however, property sales were a significant driver of the growth. They have diversified their portfolio significantly, firstly with a joint venture with Goodman Group (GMG) for investment in industrial and manufacturing property as well as acquiring a number of smaller building product manufacturers in the US to spread geographic risk. The balance sheet and investment portfolio remain in great shape however the outlook for FY23 was pretty gloomy. The company noted forward sales should carry revenue through the first half, but a significant slowdown in construction activity is likely to weigh at the back half of the year.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral to bullish BKW

Add To Hit List

Related Q&A

Whats MM’s current view towards BKW please

Does MM like BKW or SOL?

Does MM like SOL &/or BKW?

MM’s thoughts on SOL , BKW and JLG please!

CSR v Brickworks (BKW)

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.