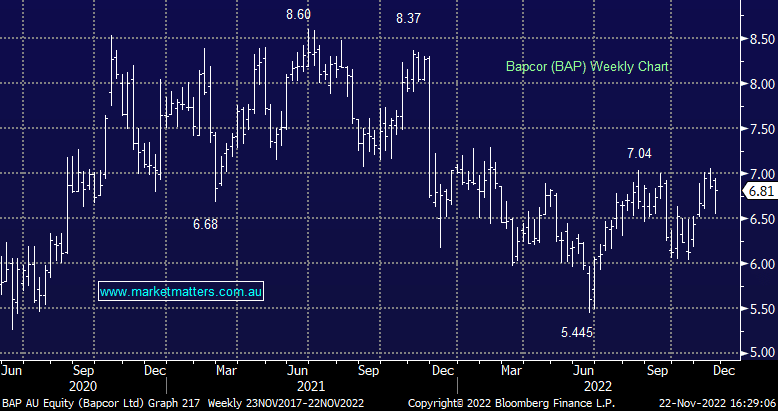

BAP -0.58%: the aftermarket auto parts business hosted an investor day today, with shares falling on weaker commentary. While they have seen strong revenue growth so far this year, margins have been squeezed by higher costs from labour, supply chain and general inflation. They do expect to pass these costs on to customers and margins will revert, however, there will be some lag here. The company spent some time talking about the forecast growth in the Australian car market, and EVs in particular, and how they can leverage this opportunity with new products and services. Overall, despite the margin pressure, we were impressed with today’s presentation.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish and long BAP in the Emerging Companies Portfolio

Add To Hit List

In these Portfolios

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.