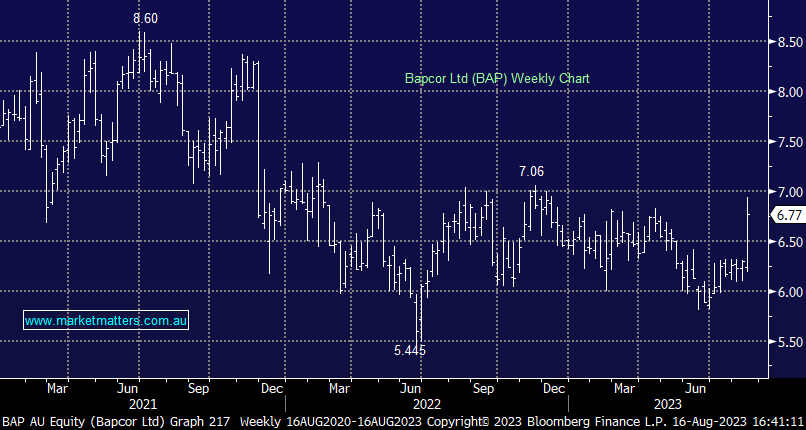

BAP +5.45%: Shares rallied today after the automotive parts company put out FY23 results that were broadly in line with consensus. Revenue of $2b was as expected, Net Profit After Tax (NPAT) $125.3m vs $127.8m is ~2% short while the final dividend is slightly better at 11.5c vs 11c expected. The second half was highlighted by higher cash conversion rates as the company looked to reduce inventory levels. They have begun to implement the “Better than before” program which aims to improve operating efficiency across the group with the aim of “achieving at least a $100m” EBIT improvement by FY25 with early initiatives being passed through as expected, supporting an improvement in FY24. The stated aims look ahead of market expectations with consensus expecting a $65m increase in EBIT by FY25.

The outlook guidance was largely broad brush commentary, looking for Trade growth to return to more normalized longer-term levels, wholesale to improve on consolidation opportunities, and retail to continue to face headwinds while NZ is likely to see an improvement in FY24. The company noted cost headwinds remain, particularly on interest costs however the balance sheet is in good shape and the company is well placed to continue to grow. BAP is trading on a 12% discount to its historical average PE, a sign that investors were largely expecting a weaker set of numbers at today’s result.

- We expect the market to like the progress on their “Better Than Before” targets, on track to deliver at least $100m uplift in EBIT by FY25.