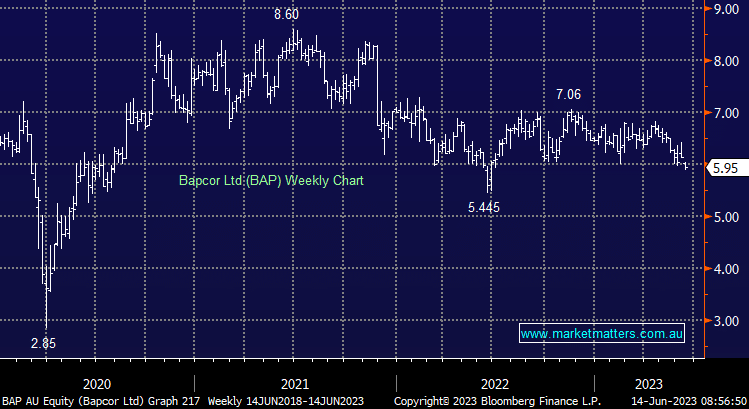

The auto parts company closed below $6/share for the first time in nearly 12 months following Citi downgrading the stock to a hold from a buy on two main concerns. The first is a slowdown in retail spending impacting near-term earnings. Citi references Super Retail’s recent trading update as a sign consumers have pulled back discretionary spending, however, the update in May showed that their Auto brand was growing at 5% on a LFL basis. Hence, while retail concerns are valid, it appears any spend on aftermarket auto products seems to remain resilient, which holds true historically as well.

The analyst also flags a potential slowdown in the Thailand growth story which would be likely to weigh on medium-term earnings. Bapcor has been focussed on the Better than Before plan which aims to increase margins and add $100m to EBIT by FY25. We don’t see this as being priced in, and we are backing management to make some early inroads, picking the low-hanging fruit this half which supports a beat at the FY results in a few months. While this focus may delay the international ramp-up story, we would prefer the company to get their main earnings drivers in order first before splashing the cash to aggressively expand into Thailand.