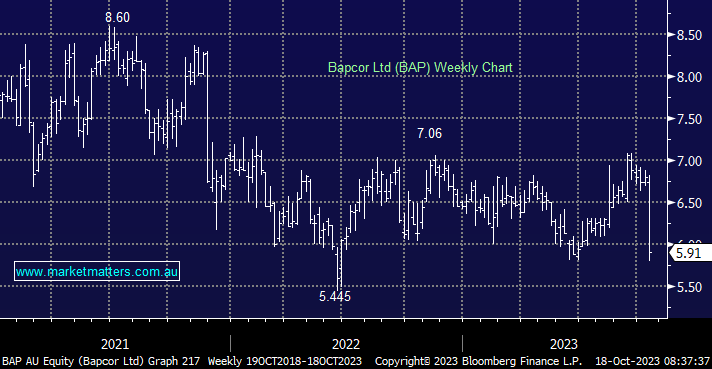

The auto parts business struggled yesterday after flagging a softer 1Q at the AGM. They are getting hit on revenue and costs, crimping earnings at the start of the year. Growth in Trade and Wholesale remains positive but slower than 2H23, while Retail has gone backwards, however, the company said revenue growth was still in the low single digits, largely in line with FY consensus expectations of 5% growth. Costs were our main concern, given we were expecting margins to continue to improve. Higher Payroll taxes, interest costs and cost inflation coming through generally weighed on earnings, putting profit so far in FY24 “in the mid-single digit millions of dollars,” according to the update. Despite a softer start, the company is confident of improving performance throughout the year, and we expect some of this shortfall to be recovered.

It’s important to note where market expectations currently sit for Bapcor. Prior to this announcement, the consensus was expecting a ~10% increase in profits in FY24 before a more meaningful jump in FY25, with these numbers seeing BAP trade on ~15x earnings. We see this as cheap given the EBIT benefits the company is targeting with its “Better than Before” strategy over the next two years, with consensus-only pricing around 50% of the overall target. We expect earnings to recover through the year as repair work can only be put off for a short period, and historically, downturns in the industry are typically quicker than other industries.

- We took profit on a portion of our holding in August, and we are inclined now to increase the position into this pullback