Australian Investment Blog

Americas 20/09/2018

International Stocks to buy – an American Focus

Stocks

Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN), Netflix (NASDAQ: NFLX), Alphabet (NASDAQ: GOOGL), Apple (NASDAQ: AAPL)

Event

Facebook (FB) $US160.30

We are now neutral / bearish FB following its large correction. From a ‘layman’ perspective, it seems to us that people are using Facebook less and the move to monetise the user base, like a lot of these social media platforms is a more difficult / complicated task than first thought. Commercialising a social platform that wasn’t designed for commercialisation in the first instance is tough, while we also think FB has created many underlying social problems that with manifest into tighter regulation in the future.

MM is not keen on FB initially targeting the $US150 area.

Facebook (FB) US Chart

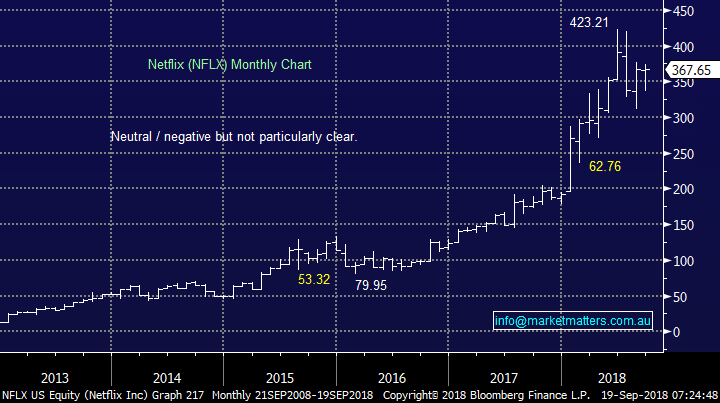

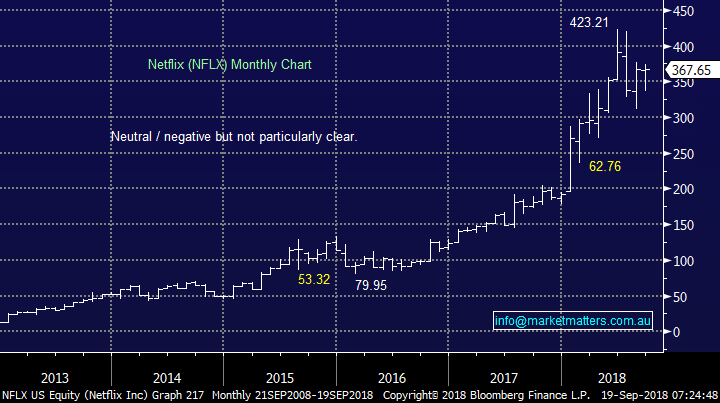

Netflix (NFLX) $US367.65

Netflix has had a relatively tough time compared to the sector with a few headwinds impacting its performance – when you’re trading on an Est. P/E of 129x there is no room for error!

MM is neutral at present.

Netflix (NFLX) US Chart

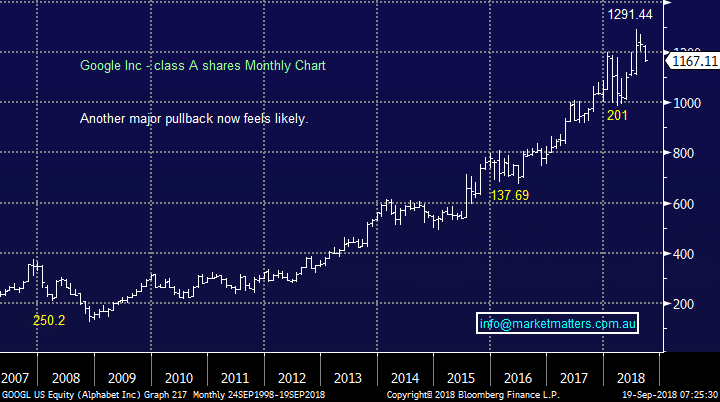

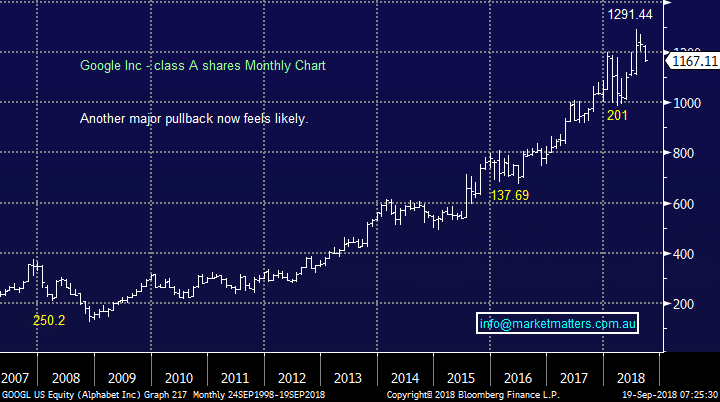

Google Alphabet (GOOGL) $US1167.11

Google shares have started “wobbling” recently and on balance we are now slightly negative targeting the $US1000 support area where the stock has spent much of 2018.

MM is an interested buyer but only ~10% lower.

Google Alphabet (GOOGL) US Chart

APPLE (AAPL) $US218.24

APPLE continues to trade from strength to strength as the business evolves very impressively– APPLE’s cash plie is now approaching $US300bn, meaning that it could almost BUY the big 4 banks in Australia outright!

MM likes APPLE in the $US200 region.

APPLE (AAPL) US Chart

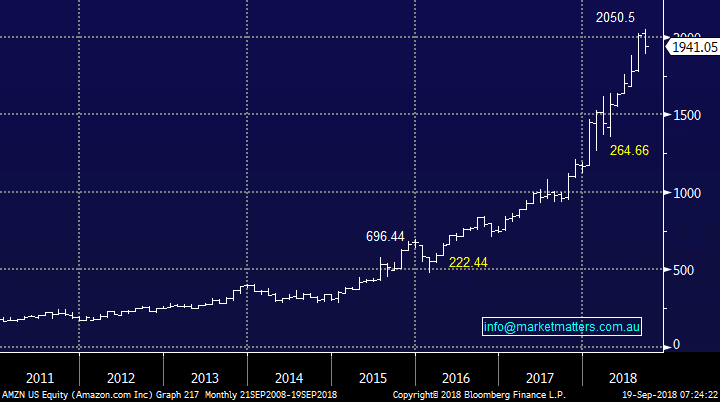

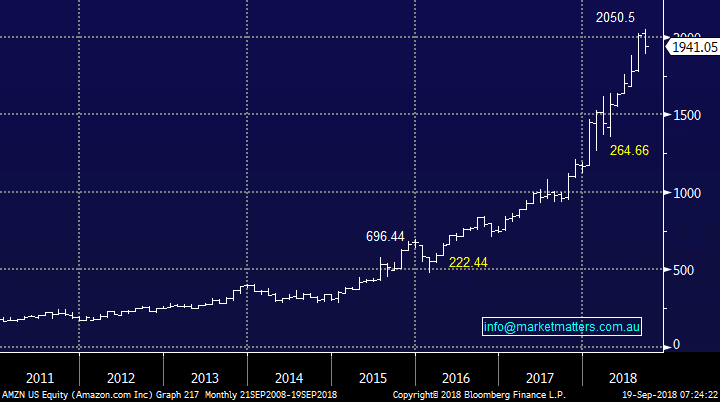

Amazon (AMZN) $US1941.05

The amazing online retailer continues to go from strength to strength and clearly it’s hard to fault the share price trends below. While the market is not focussed on valuation at the moment, instead looking at top line sales growth which is tracking at around ~30% annually, at some point. While we are cautious its large 108x Est P/E, on forecasted numbers, this drops substantially by FY20 given a doubling of projected profits.

We are neutral Amazon but would consider buying technically around the 1800 area, or 7% lower.

Amazon (AMZN) US Chart

Market Matters Take/Outlook

We are keen on Apple, Google/Alphabet & Amazon, while not interested in Netflix & Facebook

Relevant suggested news and content from the site