Expectations of a rate cut pushed out to September (ORE, JHG, MFG, CPU)

WHAT MATTERED TODAY

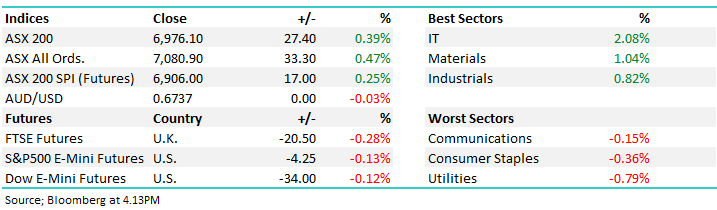

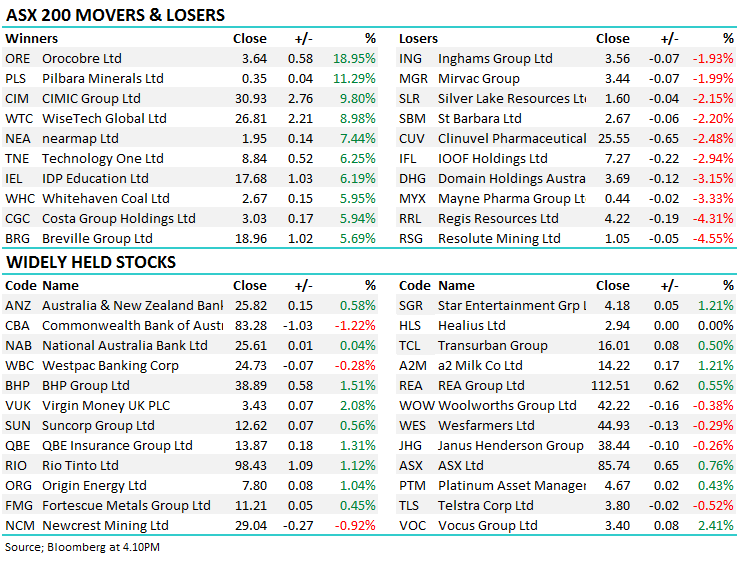

A fairly disappointing performance from the market today given the positive leads we saw overnight while Asian markets were also in the green for the day. It seemed to be the markets interpretation of the RBA commentary yesterday as traders pushed out expectations for further rate cuts – now a full cut is not expected until September. That supported the currency (AUD @ 67.36) which ultimately put some pressure on stocks. The IT sector keyed off the strong leads from the Nasdaq overnight which traded to new all-time highs while the more interest rate sensitive utilities provided most drag.

Good to see the materials find some form with our Growth Portfolio performing well today after a period of weak relative performance given our overweight skew towards the miners. Mining services company NWH won a nice contract and rallied +5% while Costa Group (CGC) has benefitted from more clouds on the longer distant forecast putting on nearly 6% - a good move.

Reporting season kicking up local with a reporting schedule available: CLICK HERE

Tomorrow we have reports from DXS, NCK & SSM. We hold SSM in the Growth Portfolio.

Overall, the ASX 200 added +27pts / +0.39% today to close at 6976. Dow Futures are trading lower by -48pts/-0.18%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Lithium Stocks; were roaring today, with Orocobre (ORE) adding 18.95% closely followed by Pilbara (PLS) up 11.29% topping the leader board for the ASX. They have caught a bid post the Tesla result which shows somewhat of an electric vehicle buying trend kicking off. Today, however, the good news came from the UK with Boris Johnson announcing plans to bring forward petrol car sale bans from 2040 into 2035. While the ban has may years before its planned to start, it does highlight a shift in policy from all leaders globally in a push to lower carbon footprint. Certainly, lithium will be a key resource in the changes in cars, and general battery demand, however we have seen lithium run ahead of demand in the past we would be keen to buy on the backfoot.

Orocobre (ORE) Chart

Janus Henderson (JHG) -0.26%: Reported Q4 numbers overnight (and FY19) and the stock fell overseas however it was more resilient locally, closing only marginally down. Fourth quarter 2019 operating income was US$154.3 million compared to US$143.6 million in the third quarter 2019 and US$150.0 million in the fourth quarter 2018. Adjusted operating income, adjusted for one-time, acquisition and transaction related costs, of US$171.0 million increased 7% compared to US$160.2 million in the third quarter 2019 and increased 3% compared to US$145.3 million in the fourth quarter 2018. In terms of FUM, they did see outflows however it was largely confined to one big mandate loss of US$5bn following the change of a portfolio manager. Mandates like this are lower margin. Elsewhere, the business held up reasonably well relative to its current trading multiple of ~10x. The performance of their funds has also improved, and this should translate into better performance fees for 2020. All in all, a reasonable result.

Janus Henderson (JHG)

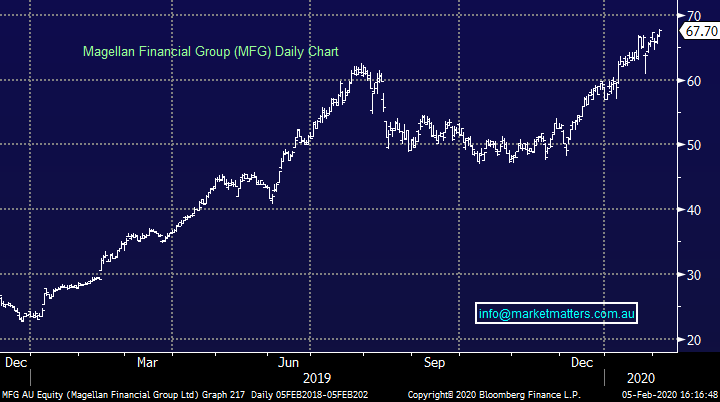

Magellan (MFG) +1.38%; traded to a new all-time high today after announcing total FUM for the group had gone through $100b for the first time. As at the end of January, Magellan had a total of $104b, up nearly 7% in the month as a result of both inflows and positive market moves. The bulk of the FUM growth came from institutional investors in the period. The beast continues to grow with little sign of slowing down. If the market can continue to catch a bid, MFG will be dragged higher with it as the stock looks set to breakout.

Magellan (MFG) Chart

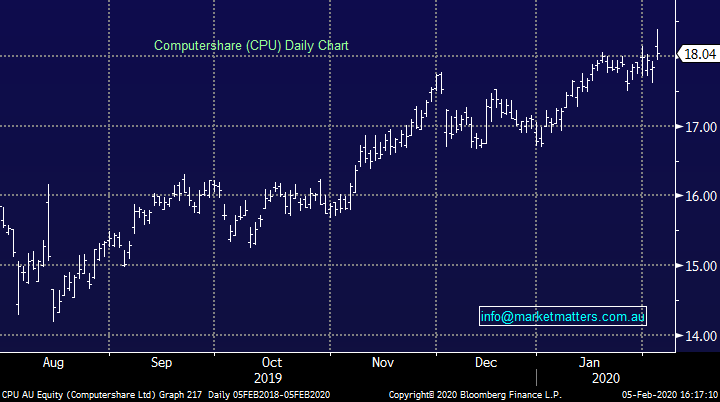

Computershare (CPU) +1.06%; announced the acquisition of small US based registered agent business Corporate Creations as it looks to further it’s offering in the US. The CEO trumpeted the move, saying it would allow Computershare “to deliver an enhanced and integrated product suite and improved service proposition” to potential US clients. Corporate Creates current service over 14k entities in the US with revenues of $US35m. Computershare will pay around $US143m in the deal, with the acquisition expected to be EPS accretive from the first year of integration. We like Computershare and own it in the Growth Portfolio.

Computershare (CPU) Chart

Broker moves;

Not available today on our feed – apologies.

OUR CALLS

Only the one tweak in the income portfolio today, reducing MXT.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.