BHP first half in line, although dividend misses expectations

BHP Group (BHP) +0.91%

1H20 numbers out this morning. Revenue climbed 3% on the first half of 2019, while net profit jumped nearly 30% thanks to a commodity price tailwind in iron ore. The $US5.2b profit was around 2% below expectations for the half. The biggest miss was the dividend, with BHP reducing its payout ratio to around 63% after running at around 70% for the past few years. This equated to a $US0.65 dividend while BHP maintained production and cost guidance for the full year.

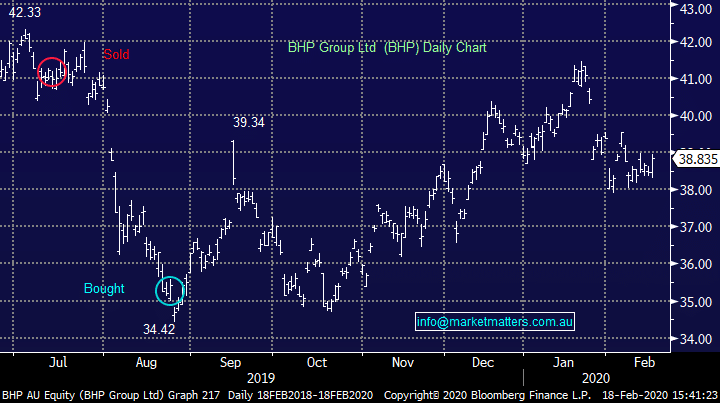

BHP Chart

Within the announcement today, BHP included a lot of forecasts which are always worth a read…Harry looks at key elements below, however the full run down is available here: https://www.bhp.com/media-and-insights/prospects/2020/02/bhps-economic-and-commodity-outlook/#technologicaldevelopments

Within the presentation deck BHP had some interesting takes on the global growth and commodity outlook, particularly in the midst of the corona virus. Some of the key economic points:

Within the announcement today, BHP included a lot of forecasts which are always worth a read…Harry looks at key elements below, however the full run down is available here: https://www.bhp.com/media-and-insights/prospects/2020/02/bhps-economic-and-commodity-outlook/#technologicaldevelopments

Within the presentation deck BHP had some interesting takes on the global growth and commodity outlook, particularly in the midst of the corona virus. Some of the key economic points:

- Noted growth slowed in 2019 focusing on the drag of lowered trade in the year, but expects growth to pick up marginally towards around 3.125% in the current year.

- Set up a bear case for China growth at 5.5% which included re-escalating trade war and lingering virus effect set to be partly offset by a reasonable stimulus injection.

- India’s expected revival has seen delay’s although economic headwinds are expected to be near their peak. India will likely become the world’s biggest importer of iron ore in the next few years given there are no resources in the country

- Noted strength in China’s demand last year was resilient, expecting levels to plateau and then decline later in the decade. They expect the long run price to shift towards a higher-cost producer supporting the iron ore price in the medium term although volatility remains for now

- Coking coal appears constructive according to BHP and despite the volatility, it seems reasonable to suggest that met coal prices can sustain above long run marginal cost

- Copper demand was weaker than expected in 2019 although a structural deficit looks set to open up as the decade progresses with prices set to trend higher to support more production

- Oil has seen an estimated 0.2Mbpd drop in demand as a result of the virus, putting pressure on prices. As natural supply slides over the decade though causing a move up the cost curve, oil looks reasonable compelling in the medium to long term