Caterpillar and its impact on BHP

Earlier this week CAT shares were down around 10% before bouncing slightly, although they still closed well in the red – as we know an earnings outlook “miss” will do that.

To be precise CAT disappointed investors by not increasing its 2018 earnings forecast, promoting fears that the heavy-duty equipment maker may be signalling a slowdown despite posting better-than-expected / best ever quarterly profits.

This is an interesting outcome when the overall US market is priced richly for ongoing growth. CAT is the largest mining equipment manufacturer in the world and investors have turned cautious due to China’s economic growth slowing to its weakest pace since the global financial crisis plus the International Monetary Fund cutting the global economic growth forecasts for 2018 and 2019.

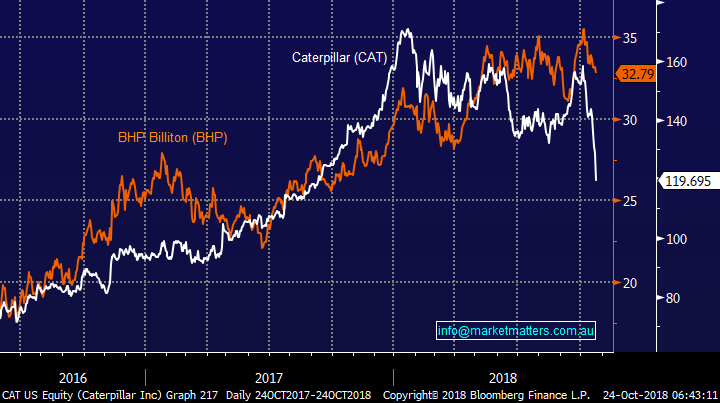

CAT has now corrected well over 30% since its March high and from a risk / reward perspective we could consider being a contrarian at current levels and buying the stock.

However just like the copper price CAT is often regarded as an economic bellwether so if the weakness does continue it will be a concerning indicator that all’s not well under the hood of the market.

The correlation between BHP, our key resources indicator, and CAT is fairly solid hence on this front we will remain patient with any BHP purchase, it may just slip in sympathy with CAT providing an opportunity closer to $31.

Plus for good measure comments from Saudi Arabia overnight sent oil tumbling 4%, not good news for BHP.

Caterpillar US (CAT) v BHP Billiton (BHP) Chart