Life Insurance under the microscope

Stock

Freedom Insurance (ASX:FIG) $0.13 as at 10/09/2018 Clearview Wealth (ASX:CVW) $1.02 as at 10/09/2018Event

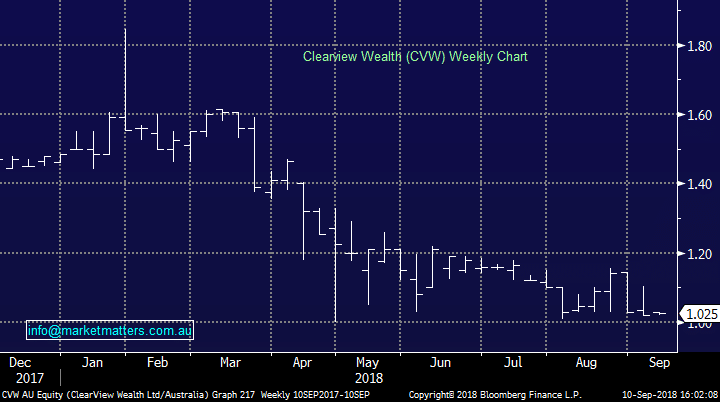

The life insurance companies came under Royal Commission scrutiny today in what was always going to be a fairly confronting dive into a sector that seems to rely on high pressure sales, cold calling and manipulative practices. We touched on Freedom Insurance (FIG) this morning however the spotlight was on their much larger rival today. Clearview Wealth (CVW) who do life insurance, financial planning and the like. While the share price didn’t move today, it’s been under pressure in recent times, down from a ~$1.80 high in January to $1.02 today. This is a stock that trades by appointment despite its ~$680m market cap, largely because Crescent Capital Partners owns 257m shares or ~38.5% of the business. It’s very hard to get excited about this stock on ~19x forward earnings and with such significant regulatory headwinds, however Blue Ocean Equities have slapped a buy and $1.50 price target on the stock today.Clearview Wealth (CVW) Chart

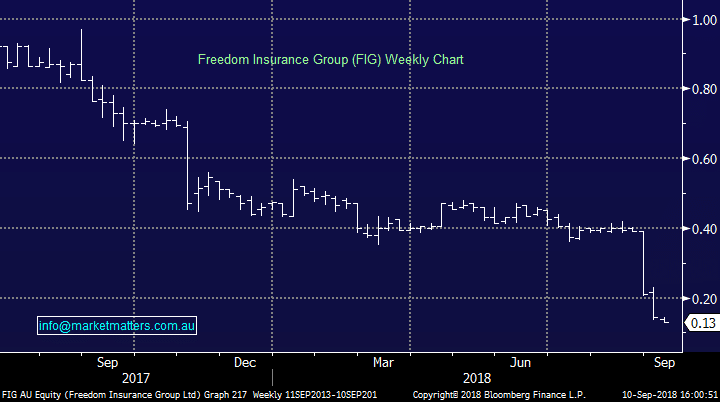

Freedom Insurance (FIG) is likely to be on the stand shortly with a similar grilling on the cards. This business is cheap, dirt cheap after falling from around 50c in January to now trade at 13c – ouch! They did miss expectations when they reported recently, but by a palatable margin however news that ASIC is conducting a review into the direct life insurance space has seen the shares really taken to the cleaners. The review by ASIC is targeting the direct sale of products to consumers i.e. no advice provided which is Freedom’s bread and butter. FIG creates the product, markets and distributes that product and administers policies direct to customers they have sourced through their channels.

The ASIC review is directly targeting this space, which is sort of ironic given they’ve just pulled the pants down on the advice side of the ledger and now they’re targeting businesses that provide the consumer with products (without advice). Anyway, the industry is under scrutiny and probably rightly so given what I’ve heard today from the RC.

Freedom Insurance (FIG) is likely to be on the stand shortly with a similar grilling on the cards. This business is cheap, dirt cheap after falling from around 50c in January to now trade at 13c – ouch! They did miss expectations when they reported recently, but by a palatable margin however news that ASIC is conducting a review into the direct life insurance space has seen the shares really taken to the cleaners. The review by ASIC is targeting the direct sale of products to consumers i.e. no advice provided which is Freedom’s bread and butter. FIG creates the product, markets and distributes that product and administers policies direct to customers they have sourced through their channels.

The ASIC review is directly targeting this space, which is sort of ironic given they’ve just pulled the pants down on the advice side of the ledger and now they’re targeting businesses that provide the consumer with products (without advice). Anyway, the industry is under scrutiny and probably rightly so given what I’ve heard today from the RC.

Steve Johnsons Forager Funds Management commentary

Steve Johnsons Forager Funds Management is 2nd on the register holding ~11% of the company. They recently wrote about FIG’s accounting policies which I found interesting…The upfront commission and the present value of this entire stream of future payments are both booked immediately as revenue. So in the early years of its existence, the company reports revenues well in excess of actual cashflows. As it matures they should roughly match. And if it stops writing new policies the cashflow will continue flowing for years despite not reporting any accounting revenue. So, while it has a huge impact on the accounting profits, we aren’t overly concerned whether Freedom’s level of new sales changes by 10% or 20%, as long as it keeps building the annuity stream. If Freedom can generate about $60m of annual sales for each of the next three years, the value of the resulting stream of payments justifies the current market capitalisation of $110m. If the business doesn’t grow there is little downside. Should growth return then Freedom should prove a great investment. Currently the Fund’s investment represents 4% of the portfolio. (source Forager Funds Management)Freedom Insurance (FIG) Chart

Market Matters Take/Outlook

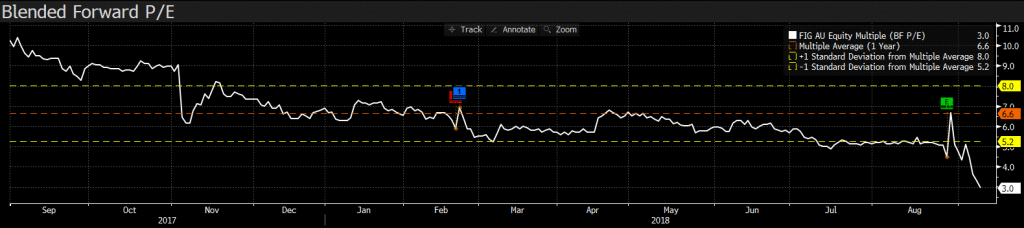

FIG is down a long way since Forager write their piece. Now trades on a P/E of just 3x, has very little debt and some cash on the balance sheet. While the company is too small for us, and liquidity is an issue, its hard to argue that it's not dirt cheap! A speculative stock for the watchlist. FIG P/E Chart