Westfield takeover rumours ignite the property sector (SCG, WFD, ANZ)

WHAT MATTERED TODAY

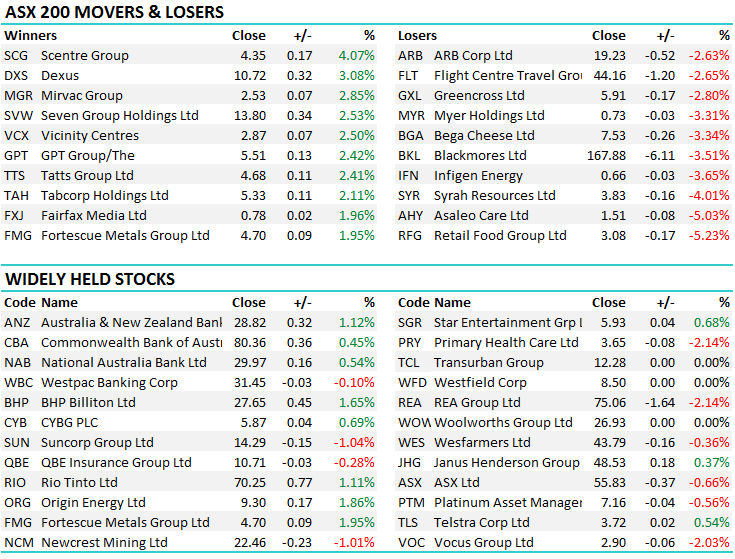

Finally, a day that saw the market close near the highs of the session and importantly, above the 6000 mark for the first time in around 12 days. Some good buying in the unloved REIT sector following speculation of a deal for Westfield which went into a trading halt early with reports of a potential $20b bid for the US exposed landlord. The AFR saying that - the smart money is on a revived bid from European giant Unibail-Rodamco valuing the ASX-listed Westfield at more than $20 billion. The bid is expected to be cash and scrip in nature, and come following a strong run in both companies' share prices. It's also expected to be at about a 10 per cent premium to Westfield's last close, which is typical premium when it comes to property deals. Westfield shares last closed at $8.50, which put a $17.7 billion equity value on the company. (source AFR)

That put a decent bid tone under that sector which is good for our holdings in Vicinity (VCX) which put on +2.5% to close a $2.87 – Apparently a 6pm press conference going on but details are scarce (sort of). Anyway, a deal here would reignite the sector that everyone loves to hate at the moment given the backdrop of higher interest rates in 2018 and beyond. Similar story playing out in Sydney property with the media reporting BIG falls but for quality assets there is still decent appetite.

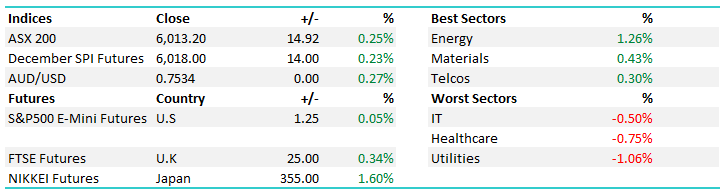

Anyway, a big day in corporate Australia and I tried to cover most this morning in Direct From The Desk – Click HERE...On the mkt today, the Energy stocks were best on ground while the utilities struggled again – third straight session! An overall range today of +/- 16 points, a high of 6015, a low of 5599 and a close of 6013, up +15pts or +0.25%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

TOP MOVERS

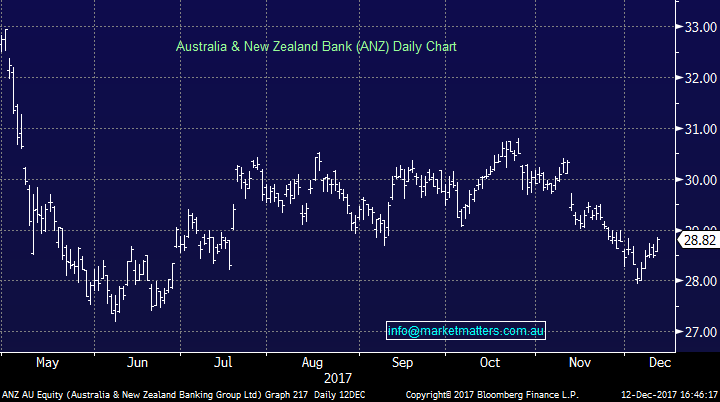

1.ANZ announced the sale of their life business this morning which is a marginal positive. Importantly, the transaction is EPS & ROE neutral assuming they conduct a buy back, adds 65bps to capital (CET1) with the completion late 2018. They sold it for 15.1x 2017 PE so no real change to their earnings mix (assuming buy back is completed) but makes the bank a cleaner and simpler proposition. To give some context around the price, CBA sold Comminsure for 16.9x PE so clearly CBA look to have done a better deal. We own CBA, NAB, WBC and CYB and remain bullish the banking sector into Christmas – with the end of the December the most bullish period of the year.

ANZ Daily Chart

2. Property stocks – were the shining light on the ASX today following speculation of a bid for Westfield (WFD). WFD remains in a trading halt however Scentre Group (SCG), which is the domestic spin off of WFD was up +4.07% to close at $4.35 – clearly a big move and the wider property sector was very strong. When you get a decent multiple paid, clearly investors gets refocussed on the imbedded value in the sector over and above the media / market hype about an impending property crash. No deal announced yet, just speculation however clearly when there is smoke…!

Scentre Daily Chart

Elsewhere, we covered the major themes in the DIRECT FROM THE DESK recording early this morning. CLICK HERE

OUR CALLS

No changes to the portfolio’s today, however our bullish positioning towards financials is starting to play out.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here