Afterpay & Cimic rocket – ASX 200 grinds higher (APT, Z1P, CIM, EVN, OZL, AWC)

WHAT MATTERED TODAY

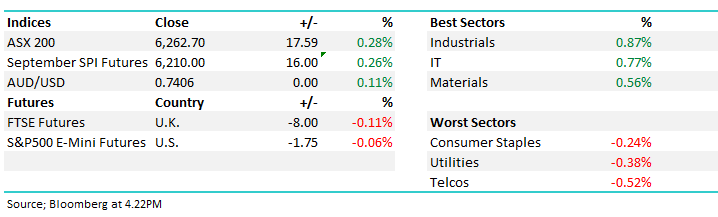

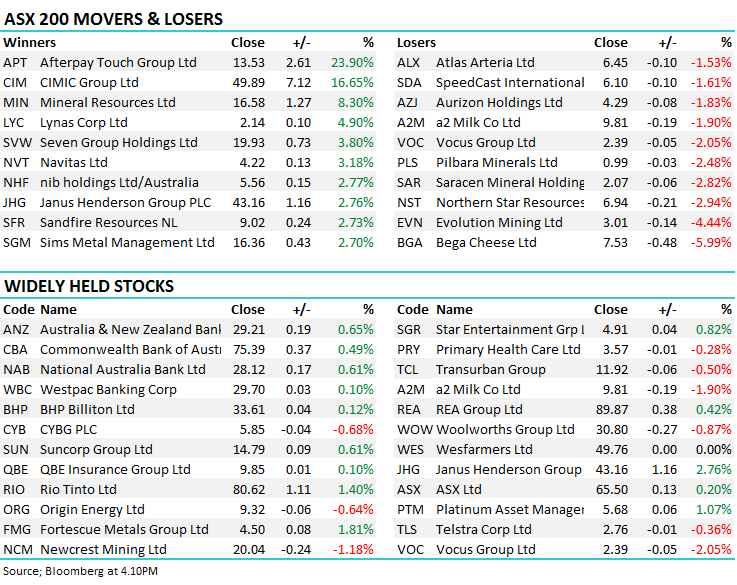

A lot across the ticker today on a stock level with a number of production updates from Aussie miners while two of the new payment stocks – Afterpay (APT) and Zip (Z1P) provided market updates which we’ll cover below. Overall the market did reasonably well following a marginally positive lead from overseas while a mixed day across Asia Pac provided some additional support. Overall there was a higher degree of risk on sentiment with the Industrials, IT stocks, Materials and Financials all doing well, while the typically defensive areas lagged – Telcos were the weakest link, down 0.52% on the day.

In terms of economic data, the jobs report was the headline act and this showed the labour market remains in good shape. Employment was up by an aggregate of 51K, with the strength concentrated in full-time jobs. The unemployment rate was unchanged after ticking down to 5.4% last month even though the participation rate increased as the participation rate rose. All up, a good report and the Aussie dollar edged higher on the news.

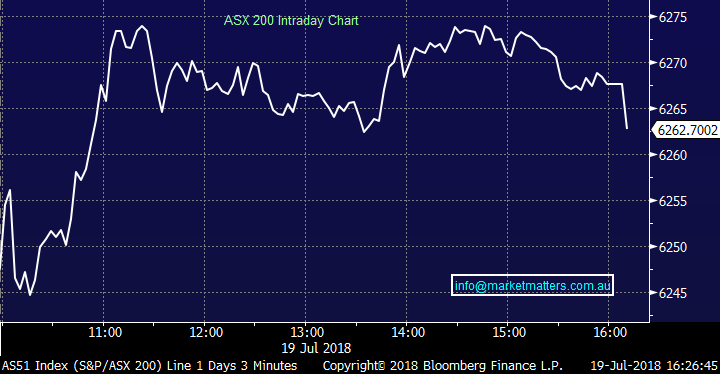

Overall, the ASX200 added 17 points, or 0.28% to close at 6262 – Dow Futures are currently trading down 1pt

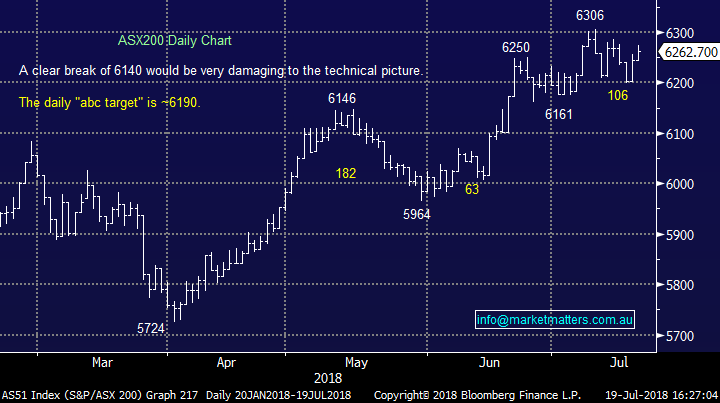

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Production reports; We had a number of production reports out today and on the whole, they were fairly pleasing;

Alumina (AWC) – A good result with the Alumina segment delivering a strong number - margins the best we’ve seen by a long way /up 15% on previous best. We’re also seeing supply side constraints globally with a Brazilian outage = ~3% of global supply likely in place for at least another 6 months which should provide some support to prices. We like AWC and remain keen to re-enter at some point in the future. AWC closed unchanged at $2.78.

Oz Minerals (OZL) – another good period where Oz management have delivered on expectations - they’re track for FY guidance and project build whileProminent Hill is delivering to plan on all production and cost guidance and the Carrapateena project is on track. Simply a good result from Oz with the stock flirting around our desired $8.80/$9.00 entry level, my only real concern at the moment is the AUD denominated Gold price which is relevant to Oz (Gold is about 20% of their revenue). Oz remains squarely on our radar, ending its session up 2.56% to $9.23.

Evolution Mining (EVN) – this was a more mixed bag with a meet to FY18 guidance but they did bring FY19 guidance lower. EVN delivered FY gold production towards the high end of guidance range = Meet. This augers well for the FY results with costs also falling within guidance. Shouldn’t be big earnings changes … But FY19 outlook (1st posted) highlights production slippage and cost hikes. Not so good. the stock closed down 4.44% to $3.01.

Broker Moves; Cimic (CIM) has found some support from a number of brokers after a strong 1H result and jump in dividend. The ‘old leightons’ having a corker today ending 16.65% higher to $49.89.

Elsewhere….

· Fairfax Media Downgraded to Neutral at UBS; PT A$0.80

· Codan Rated New Outperform at Taylor Collison; PT A$2.83

· Bapcor Rated New Buy at Baillieu Holst Ltd; PT A$7.70

· NRW Holdings Downgraded to Hold at Moelis & Company; PT A$1.87

· Navitas Upgraded to Outperform at Macquarie; PT A$4.55

· Ainsworth Game Upgraded to Neutral at Macquarie; PT A$1.10

· Sandfire Upgraded to Hold at Morningstar

· Cimic Upgraded to Outperform at Credit Suisse; PT A$47.50

· Cimic Upgraded to Overweight at JPMorgan; PT A$48.90

· Navigator Global Cut to Hold at Shaw and Partners; PT A$5.50

· Bega Cheese Downgraded to Hold at Bell Potter; PT A$8.50

· Northern Star Downgraded to Underweight at JPMorgan; PT A$6.30

Afterpay (APT) $13.53 / +23.9% & Zip Money (Z1P) $1.01 / -3.35%; Zip released their June Quarter report today which seemed impressive, but saw the stock fall ~4% early in the day and struggle to recover. Zip passed an important milestone as the first time Zip was cash flow breakeven – adding $0.7m over the quarter. Funding costs were also seen to be falling, along with operating costs relative to the loan book helped significantly by the growth in transaction volume which was up 135% over the FY18 period. Bad debts were steady at 2.61%, although well above the 1.86% for the same period last year. So all this begs the question – why is Z1P lower today? It seems many in the market are fixated on the significant growth rate that Z1P will have to sustain if it is to thrive, while bad debts are seen as a potential problem to long term margins and cash flow.

Zip’s main competition, Afterpay, seems to be working hard to ensure they are the go-to point-of-sale credit platform. Afterpay dampened the fanfare regarding Zip’s quarterly with a business update of their own, showing sales had grown 289% for the year with 2.2M customers on the platform – well above the ~740K for Zip. Afterpay also noted their successful transition into America, with 200 retailers now live, while progress has been shown with respect to various regulatory queries including a cap being enforced on late fees. It seems APT has won this round.

Zip Co (Z1P) Chart

Afterpay Touch (APT) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here