A strong end to the week as earnings season heats up

WHAT MATTERED TODAY

A more bullish morning session than was being indicated by the futures markets played out today with the market putting on a quick +40pts from the early lows – sort of felt like a few fundies hit the buy button to get exposure as the market remains resilient – although the volumes have been really light this week which has amplified the moves. Banks jumped out of the blocks strongly, offsetting some weakness amongst many of the mining stocks – the market seeing its highs early on before trickling lower into the afternoon session.

Stocks in Asia were well supported thanks to what looked like government support coming in for the Chinese Yuan. The big stock rout in China has been influenced by currency weakness, a theme Mr Trump picked up on last night and today the Chinese seemed to be providing some sort of support for it, which caused a decent rally in most Asian markets. The intervention in the Yuan will likely lead to some weakness in the US Dollar – a move we positioned for today by selling out of our long US Dollar ETF.

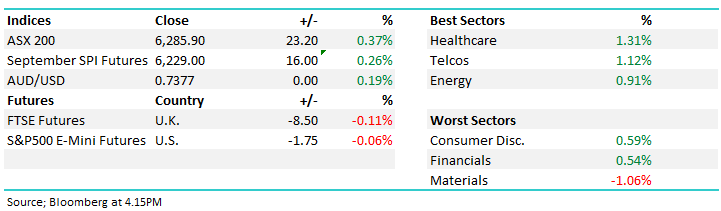

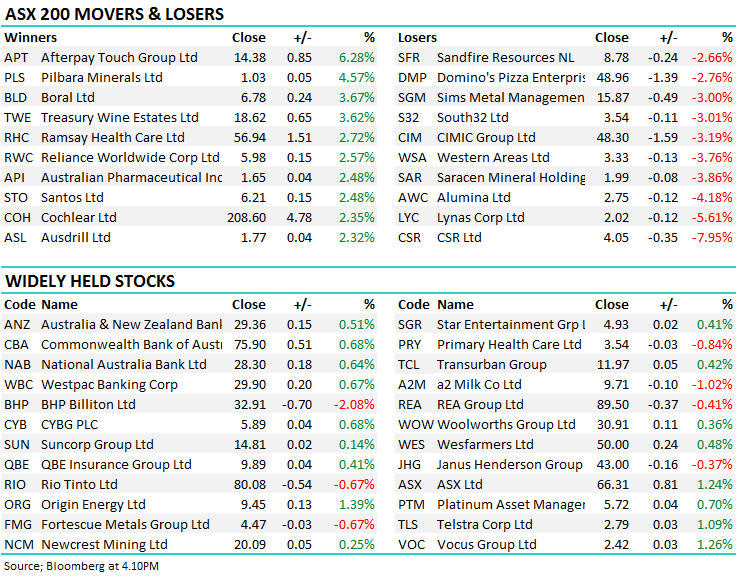

Overall, the ASX 200 closed up +23pts or 0.37% at 6285 – adding +0.28% for the weeks trade. The DOW Futures are currently down -60pts

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

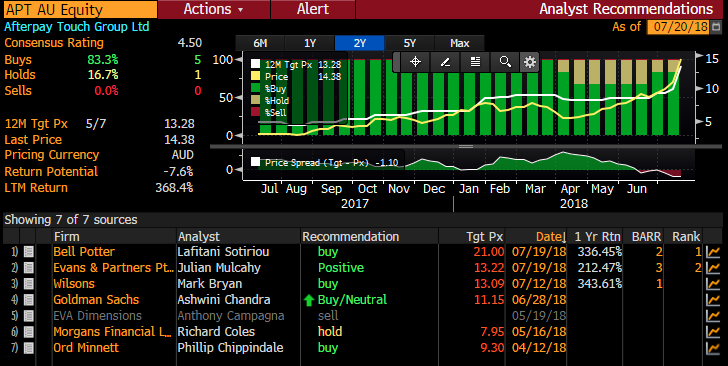

Weekly Moves – Strong earnings from the likes of Cimic (CIM) helped to propel the industrial stocks to the top of the leader board for the week while the Telco’s also did well. The Healthcare Index was only marginally in the green for the 5 days, however there was some strong buying coming into the sector towards the end of the week. CSL & COH continue to attract cash while Ramsay (RHC) is finding some friends after a fairly torrid few months – the stock now looks bullish here.

Sector moves over the week

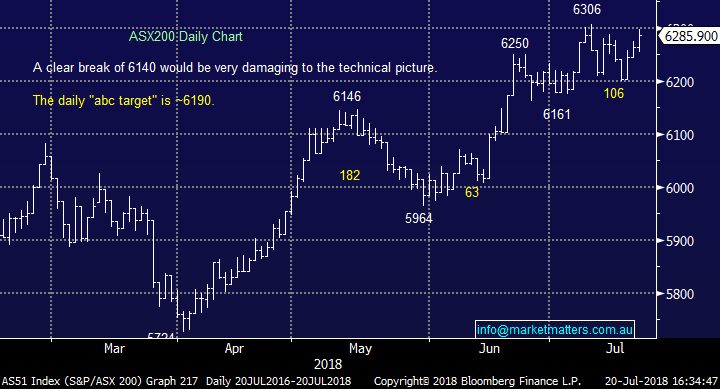

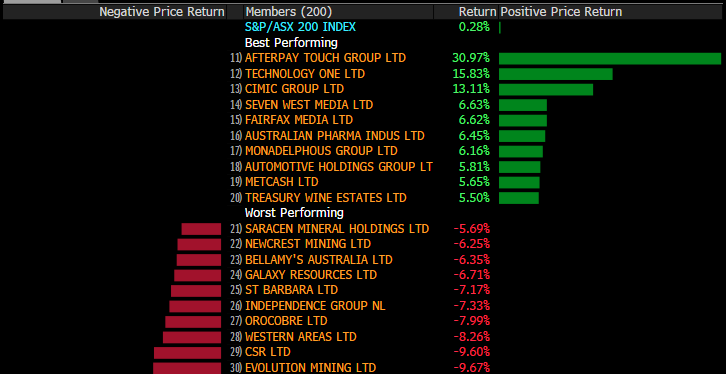

Afterpay Touch (APT) has clearly been the talking point for much of the week – the stock adding +30% on better earnings but more importantly, evidence that the US roll out has legs and is on track for bigger / better sales than the market had anticipated. Without throwing cold water on a stock that has clearly been a fantastic play to be in, shorts were high in APT (about 6% of the free float), so this weeks move would have been a combination of natural buying, but also forced buying from shorts that have been hurt on this one. 6% of the free float IS about 12m shares - It traded a total of 6.7m shares today but its 4 week average is around 1.6m shares per day.

Bells have been the most bullish supporter of this stock and this week they slapped a huge $21 price target on it, up from $10.41!! The stock has rallied from a weekly low of $10.36 to an high or $16.19 before closing at $14.38.

Broker calls APT

Stock moves over the week

Broker calls;

- OZ Minerals Upgraded to Buy at Deutsche Bank; PT A$10.25

- Cimic Downgraded to Sell at Morningstar

- Sims Metal Downgraded to Sell at Morningstar

- QBE Insurance Upgraded to Buy at Citi; PT A$11.20

- CC-Amatil Downgraded to Neutral at Citi; PT A$9.50

- Santos Upgraded to Neutral at Citi; PT A$6.04

- South32 Upgraded to Buy at Citi; PT A$4.30

- CSR Downgraded to Sell at Goldman; PT A$3.85

- Navitas Upgraded to Buy at Blue Ocean; PT A$5

OUR CALLS

We sold our US Dollar ETF for a profit small today.

Have a great weekend

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here