Platform providers feel the pinch! (IFL, NUF, HSO)

WHAT MATTERED TODAY

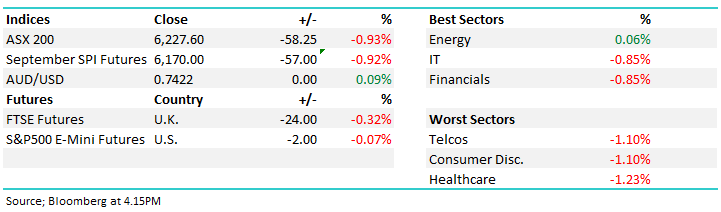

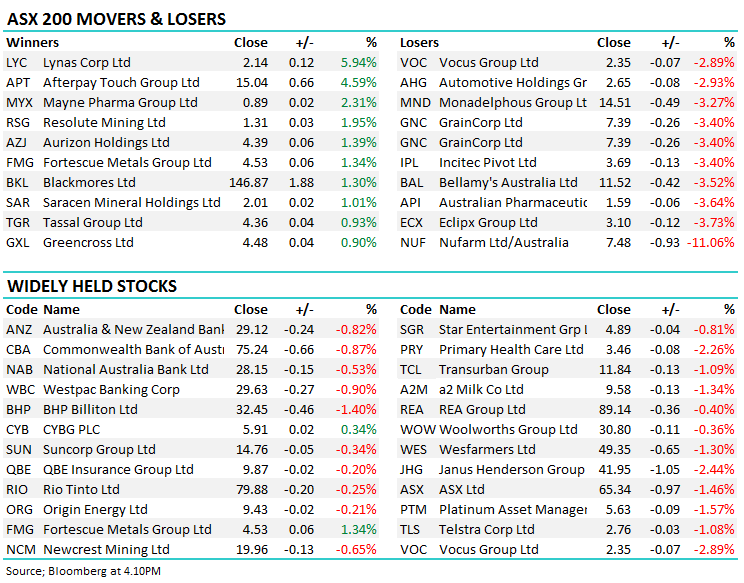

A soft opening to the week with the ASX 200 suffering at the hands of a decline in commodity prices on Friday, probably thanks to Mr Trumps continued use of Twitter which will incrementally start to have a bearing on confidence, and ultimately growth expectations. Healthcare led the loses in Australia today thanks to a cooling CSL share price (-1.17%) while the banks held up from a relative sense.

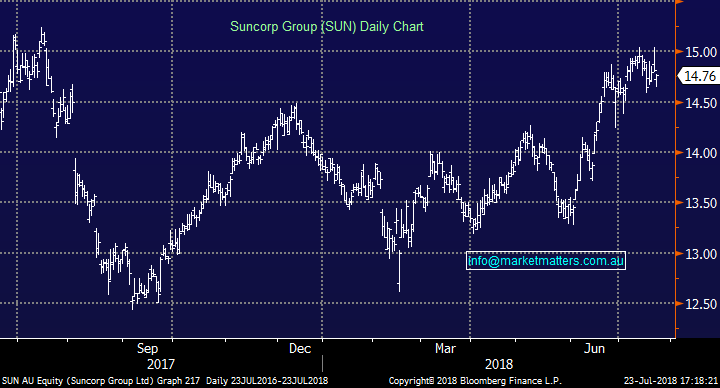

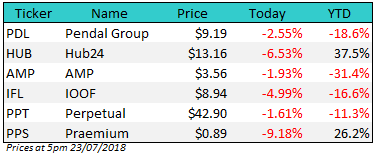

Much of the selling today looked to be futures led given the broad-based nature of the declines, however one obvious area of pain was in the Investment Platform space after BT announced plans to reduce pricing across the board – big moves to the downside played out with the likes of IOOF (IFL) down ~5% while HUB24 (HUB) and Praemium (PPS) fell ~6% & ~9% respectively – more on this later.

Elsewhere, Nufarm (NUF) came out with another earnings downgrade and some very negative commentary around the state of the agricultural sector – NUF dropped by -11% however the rest of the sector also felt some pain (IPL, GNC and the like). Extremely tough conditions have led to low demand for crop protection which has underpinned a big decline in earnings.

Overall, the ASX200 lost -58 points today, or -0.93% to close at 6227 – BHP took 5.5points from the Index while CSL accounted for 1.2 index points. Dow Futures are currently trading down -3pts.

We remain neutral here, with the trigger to turn more bearish at 6140 on the XJO.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

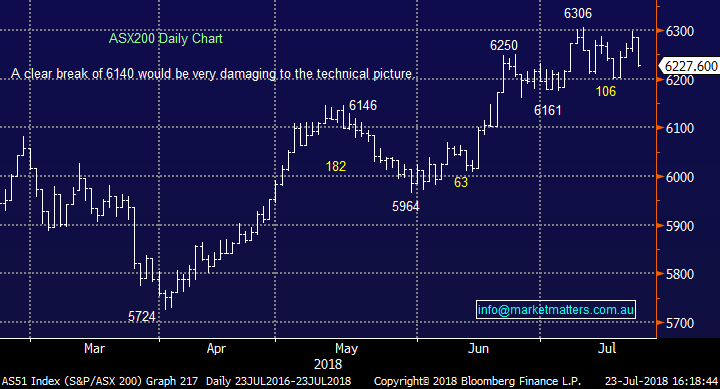

Broker Moves; Citi is moving further from consensus by calling a sell into the retail rally while they’ve become more bullish on REITs with office, industrial and funds management in their sights. Morgan Stanley put out an interesting note on Suncorp (SUN) saying they may struggle to hit their FY19 return on equity target (which sits at 10% for cash RoE). We think that’s an obvious risk in the stock, particularly given that it’s now rallied well from the $13 region to hit $15 last week. We are looking for further opportunity to reduce SUN into strength.

Suncorp (SUN) Chart

Elsewhere;

- Scentre Group Downgraded to Sell at Citi; PT A$4.11

- Scentre Group Downgraded to Neutral at Macquarie; PT A$4.46

- SCA Property Downgraded to Sell at Citi; PT A$2.18

- Charter Hall Retail Downgraded to Sell at Citi; PT A$3.76

- CC-Amatil Downgraded to Underperform at Macquarie; PT A$8.87

- Sydney Airport Downgraded to Neutral at Macquarie; PT A$7.10

- Woodside Upgraded to Buy at Morningstar

- Alumina Upgraded to Hold at Morningstar

- ASX Downgraded to Sell at Morningstar

- Mayne Pharma Upgraded to Outperform at Credit Suisse; PT A$1

Platform providers; This morning BT announced a large reduction in platform pricing to an admin fee of 0.15% and an account fee of $540 p.a. It also announced a new online services hub which provides advisers with governance, advice tools, investment research etc. While the reduction in earnings is not material for Westpac (who own BT) at the moment, the implications for others are from the change - AMP for instance could be very significant for both their platform fees and their distribution. We covered AMP in a recent income report (click here) sighting the many challenges facing the stock / sector. We also recently sold our position in IOOF (IFL) for a loss given the challenges facing the advice / platform / planning space.

Looking at the performances today tells the story. The new players have had very strong runs over the past year or so, while the more traditional names have clearly suffered – yet today was across the board, just on different scales. All this ahead of the Royal Commission which focusses on superannuation and is kicking off on Aug 6. It’s a hard sector to be in at the moment!

IOOF (IFL) Chart

Nufarm (NUF) $7.48 / -11.06%; Crop protection company Nufarm heavily discounted earnings expectations pre-market this morning, pointing to a serious deterioration in business conditions for the ANZ arm. This downgrade, now the second for the year after revising EBIT guidance to ~$315mil in May, lowers full year EBIT guidance by around another 17% to $255-$270mil. “One of the driest autumns” in the past 100 years has seen sales fall significantly and margins squeezed while the market remains in oversupply. Many growers have been unable to plant and “it was now considered unlikely that a viable crop season would occur in many parts of the country” the company said.

The company expects these headwinds to continue into the next financial year as crop protection products remain in storage.Nufarm appears to have entered a downgrade cycle and broken support around the $8 level. Many headwinds remain, including the possibility of negative results from European product applications. MM remains wary of further weakness in the short term, however buying agricultural stocks into weather related issues does traditionally have merit. We’re targeting at least $7 on the downside

Nufarm (NUF) Chart

Healthscope (HSO) $2.21 / -0.9%; We touched on HSO in the weekend report, suggesting a reasonable looking buy below $2.25, today it trades below that level and is now a stock on the radar. As means of a recap, the CEO Gordon Ballantyne joined HSO in May last year, and used the FY17 result to rebase earnings and expectations which saw the stock fall from around $2.20 to ~$1.70.

Shares did recover most of the losses over the following six months, only to be hurt again at the half year result in February through weakening private hospital earnings. This softness saw corporate activity circle, and a private equity group BGH along with AustralianSuper launched a bid in April at $2.36/share.

A few weeks later, Canadian asset manager Brookfield offered $2.50 a share and the bidding war looked on. A week later however, Healthscope poured cold water on the proposals deciding not to grant due diligence to either party but launching a review into the company’s hospital portfolio. Since the announcement, HSO has fallen to $2.22, over 10% below Brookfield’s bid. This is an interesting corporate play, and we think the downside is fairly low. Certainly one now on our radar.

Healthscope (HSO) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here