A positive end to a weak month (ANZ, CTD, HSO, NHF)

WHAT MATTERED TODAY

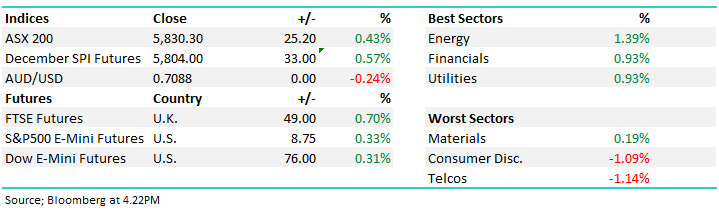

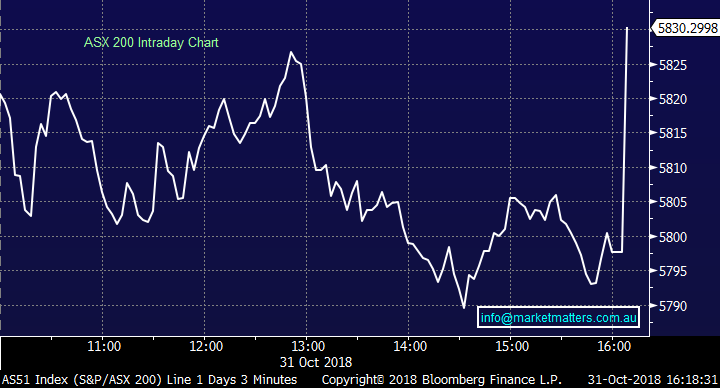

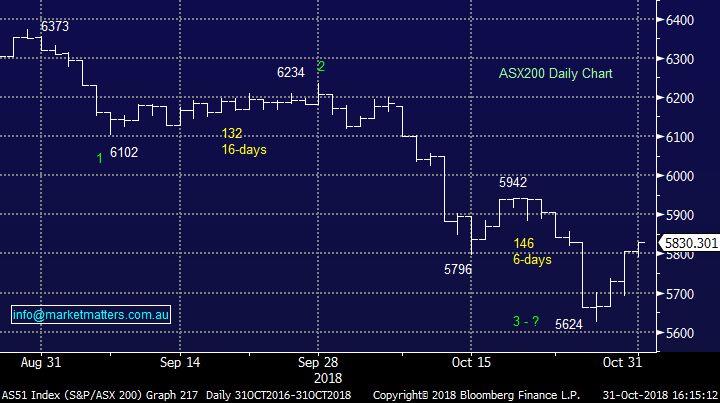

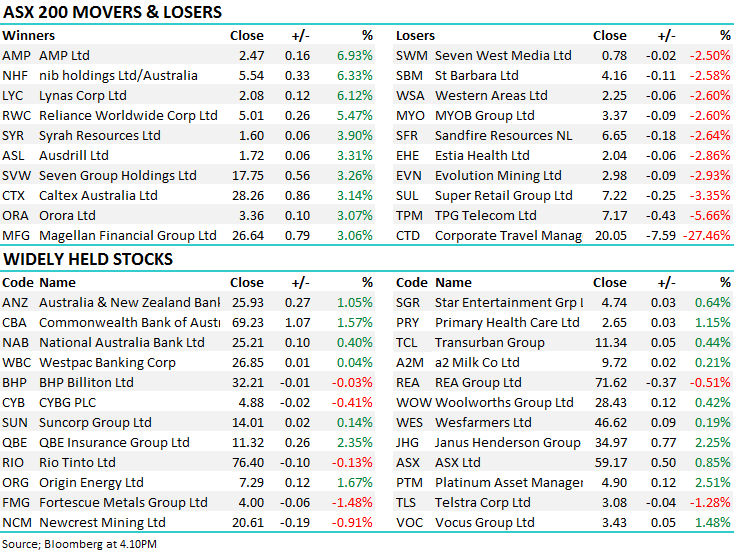

The banks helped the market open higher this morning against a negetive read from the futures market – ANZ’s solid result as well as news CBA is to sell parts of the Colonial First State business helping the big four higher in the morning. Eventually, the excitement eased as the day progressed, and the drag from resources as well as the gradual selling in banks pulled the index slightly into the red, by 4PM the index was at 5797, 30 points lower than the day’s high. A big wave of futures led buying however kicked the index higher into the final close – the ASX200 jumped 32 points in the match to help the index close higher for the day and finish off an extremely volatile month on a strong note. Energy and banks catching the majority of buying today, particularly into the close.

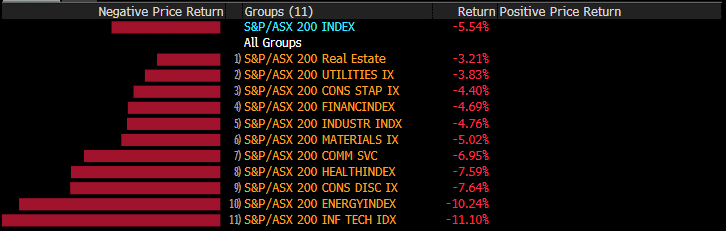

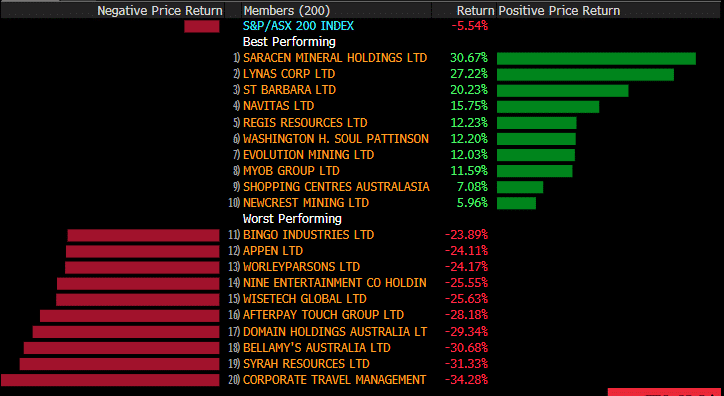

The month saw an intial 583pt / -9.4% fall to the low on 26th of October, before climbing a handy 205 points / +3.7% over the final three trading days. Overall, -6.1% fall in October (from the close on 28 September) and no sector was spared. Growth clearly in the firing line – IT and energy taking big hits, consumer discretinary follwed the housing price lower. Safe havens outperformed, however that is clearly a relative measure…

Sectors for the month

Stocks for the month

Corporate Travel resumed trading, although at a deep discount to Friday’s close, after responding to VGI’s research piece – more detail on this below. We also discuss an upgrade by NIB, Healthscope’s AGM & ANZs full year result – the first of the three banks to report a September year end, NAB & WBC to come. Genworth third quarter trading update today was weak, but not unexpected. We spoke about this in today’s income report here. Also of note today, AMP bounced +6.93% bringing an end to a 4-day loosing streak.

Today, the ASX 200 closed up +25 points or +0.43% at 5830. Dow Futures are up +76points or +0.31%

ASX 200 Chart – a huge spike after the unofficial 4PM close

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Analysts spent plenty of time on the Boral AGM & trading update yesterday. Citi & Credit Suisse saw some value now that expectations have been lowered – both cutting the price target but upgrading the call. Citi in particular believe the US housing cycle is yet to peak and weather concerns will fade helping BLD trend higher.

RATINGS CHANGES:

· Doray Downgraded to Hold at Baillieu Holst Ltd; PT A$0.40

· Nufarm Upgraded to Buy at Bell Potter; PT A$6.85

· Boral Upgraded to Buy at Citi; PT A$7

· Boral Upgraded to Neutral at Credit Suisse; PT A$5.80

· Monadelphous Upgraded to Neutral at Citi; PT A$13.95

· Lovisa Upgraded to Hold at Canaccord; PT A$8.50

· Lovisa Upgraded to Add at Morgans Financial; PT A$8.06

· Caltex Australia Upgraded to Buy at Morningstar

· Gascoyne Downgraded to Neutral at Hartleys Ltd; PT A$0.30

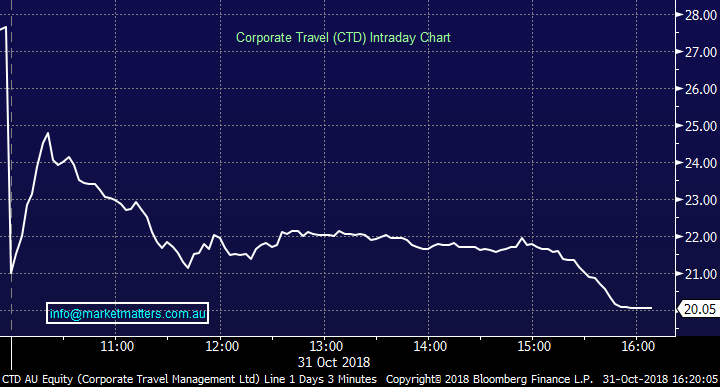

Corporate Travel management (CTD) $20.05 / -27.46%; Corporate Travel came back online this moring after a lengthy response to the short these from VGI we spoke of on Monday here. The company disputed each of the 2 red flags, and offered up a 14-page rebuttle as well as holding their AGM today. The dissertation was not enough to calm investor concerns and the stock was sold off heavily today, with one final leg lower this afternoon. Plenty more to play out here, it will be interesting to see when VGI begins to cover its short or contues its attack looking for more blood like Glaucus did to Blue Sky...

Corporate Travel Management (CTD) Chart

Corporate Travel Management (CTD) Chart

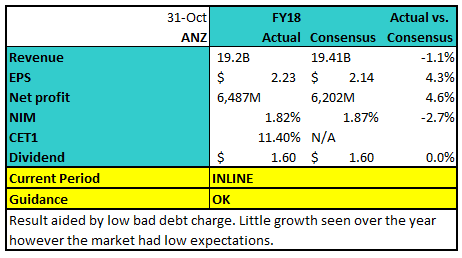

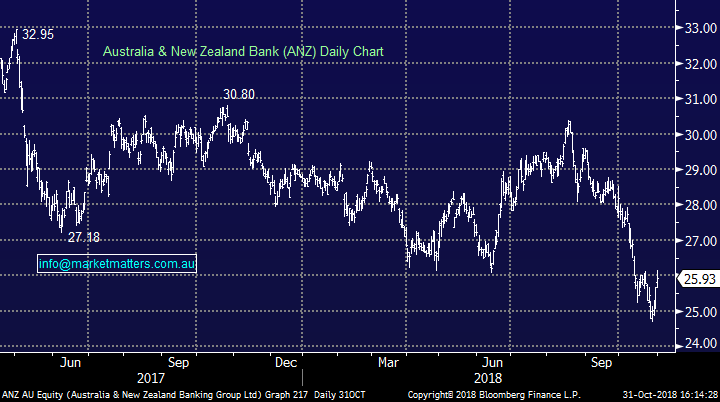

ANZ Bank (ANZ) $25.93 / 1.05%; This morning ANZ release FY18 earnings numbers that were in line to slightly better than market expectations with the key numbers as follows;

There was no growth in either income or expenses for ANZ (excluding large one-offs) from 1H18 to 2H18. The bad debt charge was very low, and their capital position was very high with CET 1 at 11.4%. That implies that ANZ has a lot more room for capital management over and above their current $3bn buyback program. There’s wasn’t a lot to get excited about in terms of the ANZ result today other than a very strong capital position and more capital management to come. That said, the stock is cheap, as are the rest of the banks. We remain bullish the sector from depressed levels.

ANZ Bank (ANZ) Chart

NIB Holdings (NHF) $5.54 / +6.33%: Health insurer NIB is holding their AGM today which also came with a healthy ~5% upgrade to guidance for FY19. Now looking for underlying profit of above $190m vs previous guidance of $180m+, the MD Mark Fitzgibbon flagged continued “benign claims environment” contributing to the better outlook. While this is good news, claims are something that NIB can’t really control hence the upgrade is of low quality in our view.

The stock has jumped today on the back of the news, recovering some if its recent slide. Private health cover, particularly in Australia, has seen stagnant levels of growth over the past few years, as wage growth stalls, cost of living pressures rise while low inflation has kept a lid on premium hikes. We find it hard to see this trend reversing any time soon, and are happy to avoid at this stage

NIB Holdings (NHF) Chart

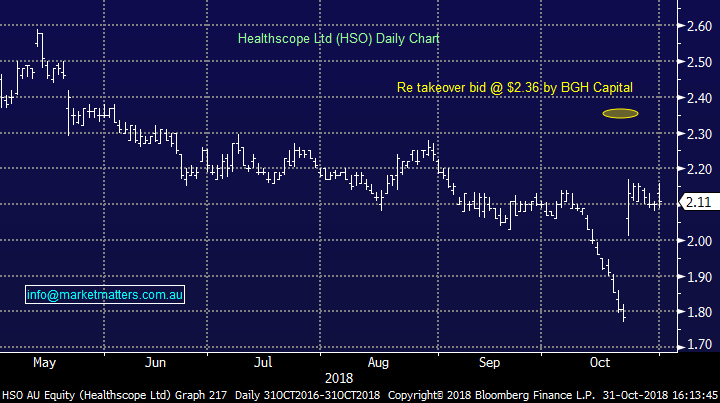

Healthscope (HSO) $2.11 / +0.48%; HSO is currently a stock in focus for a number of key reasons and this morning they hosted their AGM.

Key points for the private hospital operator;

- It’s currently under takeover from a consortium offering $2.36 per share

- That consortium increased their current stake this morning to around 19%

- The bid is conditional upon HSO maintaining earnings plus a number of other conditions

- HSO are unlikely to agree to the $2.36 bid given they rejected a bid at $2.50 earlier in the year

- HSO opened the Northern Beaches Hospital yesterday to much fanfare!

In terms of their performance over FY18, HSO had a tough year although their financial performance seems to have turned a corner in recent months. The stock is flat today despite reconfirming EBITDA guidance for growth of at least 10%.

Healthscope (HSO) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.