China and the US set date for further trade negotiations (CGC, CYB, MYR, SH US, SLVP US)

WHAT MATTERED TODAY

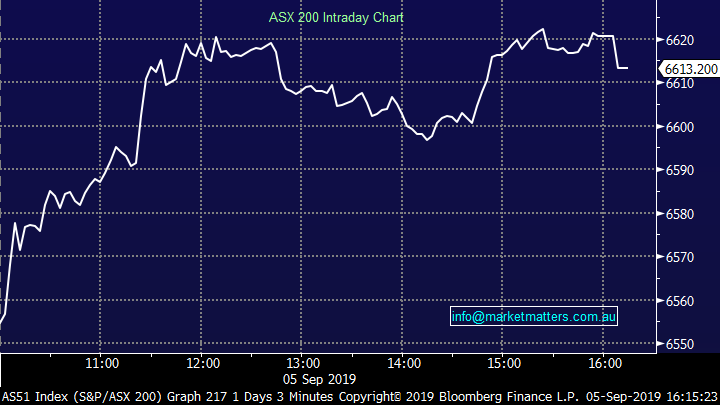

An interesting session locally with the market opening higher before news broke around 11.30am that China and the US has set a date to continue trade discussions in early October. The news was confirmed by both sides (which is a rarity!!) with Liu He, a top Chinese economic official and Beijing's top trade negotiator expected to travel to Washington to meet with Robert Lighthizer, the US trade representative, and Steven Mnuchin, the Treasury secretary. Lighthizer's office said that deputy-level meetings would take place before the talks.

That saw US Futures pop with the DOW +300pts at the best during our time zone today, Asian markets also rallied setting up a positive open overseas this evening. It was green across the screen locally today however the aspect that caught my eye was the move into value over and above those stocks with recent momentum. A nice change.

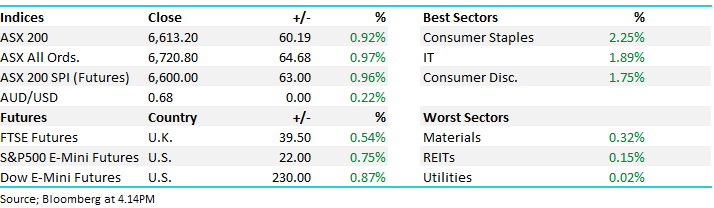

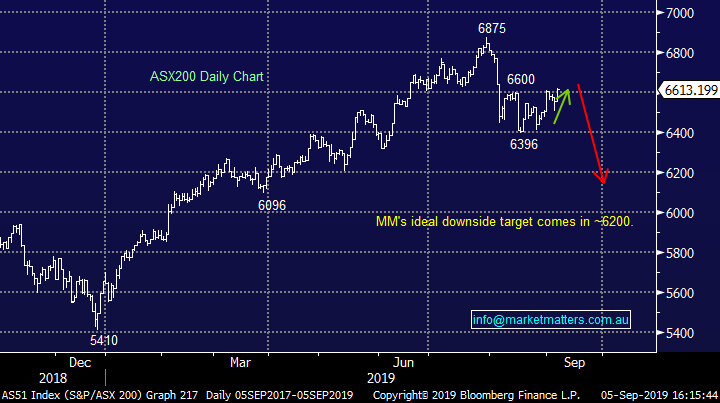

Overall, the ASX 200 put on +60pts today or +0.92% to 6613, Dow Futures are now trading up 197pts /0.70%, although that’s about 100pts from session highs

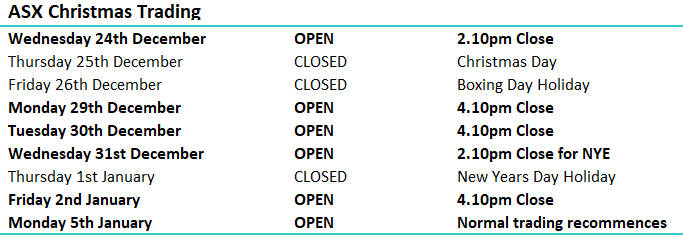

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Costa Group (CGC) +4.45%: The market was strong today, however the areas that saw most buying were those of ‘perceived value’, Costa an example of that cohort with the stock price doing well from a low base. A substantial shareholder notice out today in the stock from a local manager, ECP Asset Management confirming they have bought smack on 5% of the company, or 16,042,157 shares in the fruit and veg business.

A couple of interesting points here. 1. Buying right on 5% means they want to be known as a substantial holder, buy 4.99% and they don’t need to declare it so clearly they want it known & 2. The ~$54m investment is a big line for a manager that according to Bloomberg looks after $123m, here’s a look at their holdings where the position is greater than $1m..again, according to BB. They have a big position also in HUB.

New substantial shareholder in CGC.

Costa Group (CGC) Chart

Clydesdale (CYB) –20.28%; Announced a significant influx of claims against the PPI product it sold to mortgage clients to whom it was worthless. As the deadline for claims loomed, an influx of client information requests and complaints were made which will likely require provisions to increase more than four-fold to £300m to £450m. The exact amount of provision needed will take some time to flesh out, however this is only really half of the equation to the share price collapse today. The other half pertains to managements credibility, or now lack thereof, given they had a number of opportunities to flag this rush to the market well before today’s announcement.

The outlook for Clydesdale remains poor with loan growth minimal, and any growth coming from the higher end of the risk spectrum while funding appears to be costing more and more despite falling rates. There could be a trading opportunity in CYB given the move, but not one for MM.

Clydesdale (CYB) Chart

Myer (MYR) +10.53%; bang, had one of its best days in months after the company managed to bounce back into profit for FY19. The $33.2m NPAT was marginally better than the street expected while on a statutory basis Myer swung from a $486m loss last year to a $24.5m gain in FY19. Myer shareholders have felt pain from pretty much day 1 when they listed back in 2009 as retail struggled to get any traction and customers turned their back on the low touch, large offering model now seems I’m not the only one who does like this approach!). Myer’s lease obligations as well as poorly constructed agreements with brand partners also hurt the market’s view of Myer. This result looks to be a turning of the corner for the company, although sales continue to slide, falling 3.5% to $2.99b.

The company continues to reduce floor space, with up to 10% of current space under review, in an effort to reduce costs while also working on savings in the supply chain. Myer didn’t give guidance for FY20 but did note a focus on the online space as well as deleveraging along with the cost control.

Myer (MYR) Chart

Broker moves; We touched on the broker downgrade on CSR and subsequent decline in CSR shares yesterday, today they bounced back +4% in a bullish market. The downgrade from JP Morgan to sell equivalent and $3.50 PT comes after a strong run in the SP while we’ve also seen weakness in residential building approvals. SP strength + likely weakness across new residential development has them cautious CSR. We hold in the income portfolio and will use CSR as a funding vehicle if better opportunities present themselves in time.

WHC downgraded below however todays drop was a result of the stock trading ex-dividend for 30cps…stocks closed down 33cps.

· Synlait Milk Rated New Neutral at UBS; PT NZ$9.70

· Kiwi Property Upgraded to Outperform at Forsyth Barr; PT NZ$1.62

· Tourism Holdings Raised to Outperform at Jarden Securities

· 3P Learning Downgraded to Neutral at Macquarie; PT A$0.90

· Independence Group Downgraded to Sell at Morningstar

· Whitehaven Downgraded to Hold at Morningstar

· AMP Downgraded to Sell at Shaw and Partners; Price Target A$1.50

· BHP Group PLC Raised to Hold at Deutsche Bank; PT 17.50 Pounds

OUR CALLS

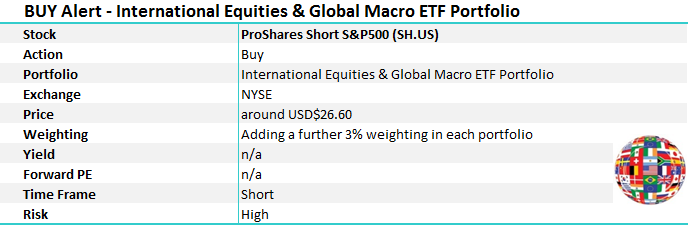

**International Portfolios** The US market will likely be strong on open this evening and we’ll use that strength to add to the short S&P 500 ETF as per below for both the Global Macro ETF and the MM International Equities Portfolio’s. We are fading the US strength after the futures market hit our target during our time zone today. This will take the short position to 8% in each portfolio.

ProShares Short S&P 500 ETF Chart

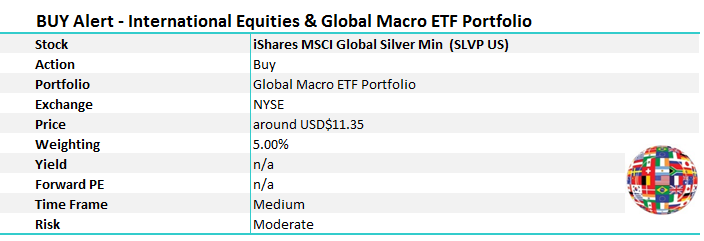

We’re also adding the Silver ETF to the Macro Portfolio around US$11.35

iShares Silver ETF Chart

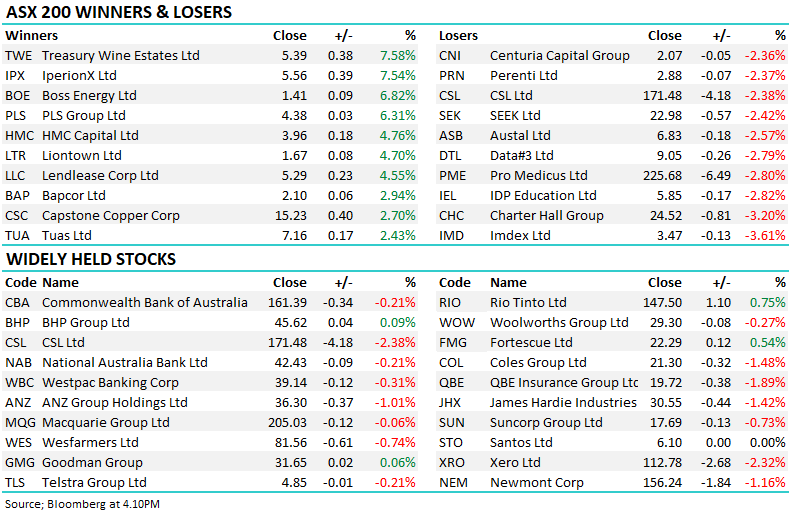

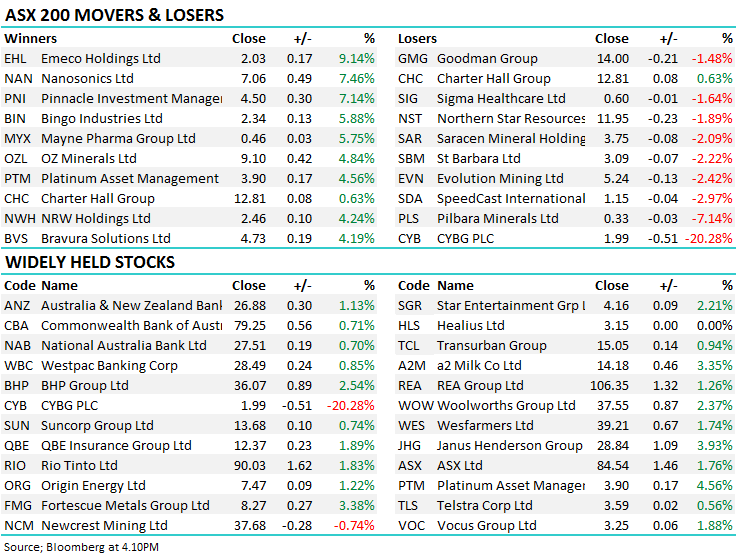

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.