Property’s good news supports market (WBC, SSM, KGN, WSA, DXS, VCX)

**AM Report**– we’ve had a couple of subscribers that were unable to see some of the charts in today’s morning note. If that was you, we’re sorry about that. To view a full version of the AM report today with visible charts, CLICK HERE

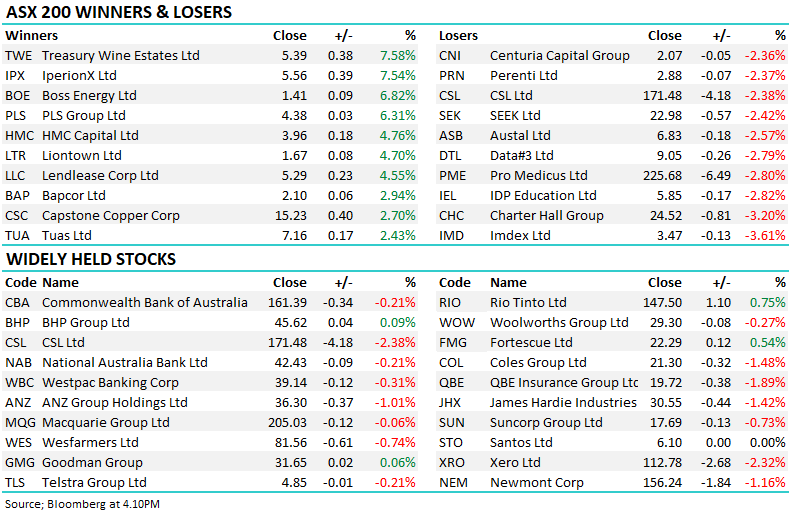

WHAT MATTERED TODAY

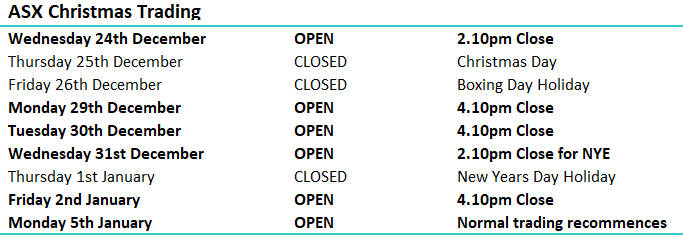

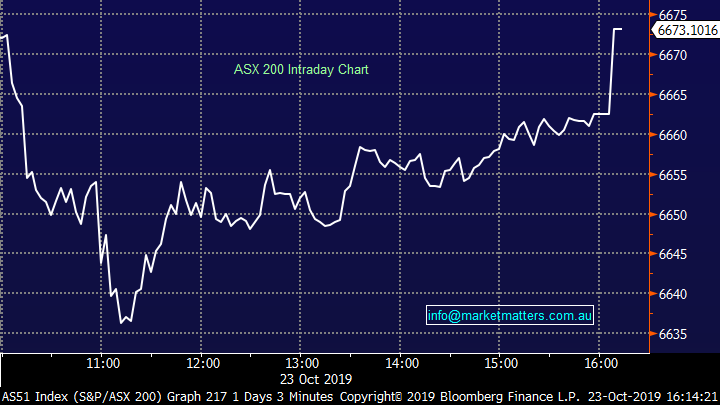

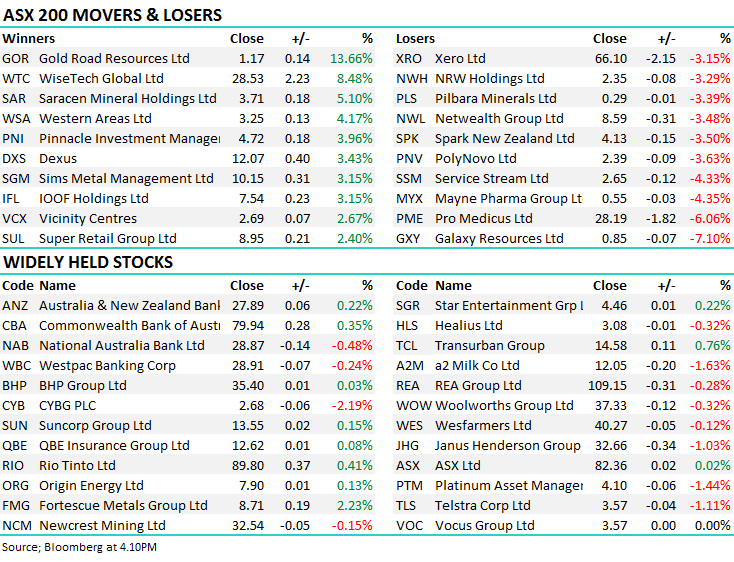

While the market closed fairly flat on the session overall there was some decent movement under the hood . Weakness early leading into an 11.30am low before a sustained grind higher into the close, the buying corresponding with some intra-session weakness creeping into the local currency thanks to a slight reduction in skilled job vacancies over the past month. Iron Ore moved higher in China, Futures +1.7% on the session thanks to a production downgrade from Vale overnight, the move supporting Iron Ore stocks today with Fortescue (FMG) +2.23% and RIO +0.41%, although they did trade down from earlier highs.

Wisetech (WTC) was back on the boards with a volatile session, eventually closing up +8.48%, Kogan (KGN) also had a volatile day after delivering a decent 1Q trading update, closing marginally higher, Harry covers that one below along with Western Areas (WSA) after they kicked off a good start to FY20 with solid production stats with the Nickel company tracking well to meet FY20 guidance for prodn/sales/costs.

At a sector level, property stocks were well supported to close +0.61% higher while the weakest sectors were dominated by the defensives, staples, healthcare & communications

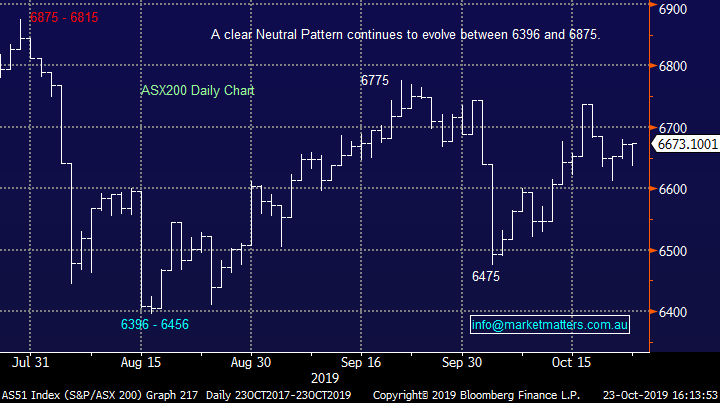

Overall, the ASX 200 closed less than +1 point higher today to 6673 – thanks largely to a big match, Dow Futures are trading down -53pts/-0.20%.

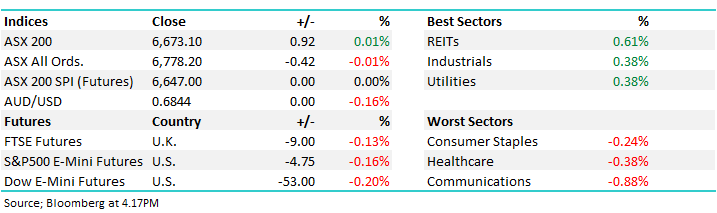

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Western Areas (WSA) +4.17%; was out with their quarterly production today – the lone ranger after a busy day of reports yesterday. The stock was up before the report hit the tabloids mid-morning and rallied a bit further after the release on a decent set of numbers. Sold nickel was up slightly on pcp, while the average price received was up to $11.50/lb, over 50% higher vs the FY19 average. Costs did track higher, as has been the case for most miners this quarter, but it still came well within guidance. Guidance was maintained on costs and total mined nickel.

The nickel market, although easing slightly over recent weeks, is still tight and miners are set to benefit through better contract terms with customers which should reduce the discount the miner receives.

Western Areas (WSA) Chart

Westpac (WBC) –0.24%; came out with their own remediation expectations ahead of the full year results in the next fortnight or so. WBC are expecting a customer remediation charge of $341m alongside a $36m for the second half, taking the full year’s total notable items to $1.13b after tax. Westpac shares held up after the announcement with remediation costs about in line with expectations, trading more or less in line with peers.

Westpac (WBC) Chart

Dexus (DXS) +3.43%, Vicinity Centres (VCX) +2.67%; the two property stocks continued the good September updates today with both trading higher. Vicinity was boosted by higher moving annual turnover (MAT) which grew 2.6% in the quarter with discount department stores the main driver. Higher MAT allows for better rent negotiations for the landlords. Dexus saw occupancy by income marginally higher at a tight 98.1% and weighted average lease expiry (WALE) out to 4.5 years. This did, however, come at the cost of rising incentives which grew to 14%, up from 13.4% at the end of the prior quarter as the office market eases.

Dexus (DXS) Chart

Kogan.com (KGN) +1%; the online retailer was out with a business update pointing to 16% sales growth and 28% profit growth vs the 1st quarter of FY18 as the company integrates a number of new products to drive revenue and scale. With the site now attracting more than 1.6m active customers Kogan has launched their own suite of energy, mobile, insurance and more to capture more of the customers spending power. Four new brands that were planned to launch at the end of the year hit the market early including Kogan’s push into personal finances with Money Credit Cards coming online earlier this month. The vertical integration continues, with Kogan Travel partnering with Corporate Travel (CTD) to offer white labelled travel services later this financial year.

The significant growth coupled with prudent cost control has resulted in a strong uptick in profits for KGN however shares weren’t confidently higher today trading in a wide range either side of par. The market is expecting lot of Kogan, but also fears the co-owners may come back the market to sell down stock at some stage so no one really appears desperate to own it at these levels – us included.

Kogan.com (KGN) Chart

Service Stream (SSM) -4.33%: was hit today, although the ~4% decline almost feels a win when the stock was off ~10% at the worst. Two factors at play here 1. The MD sold ~1m shares for personal tax reasons via an on market sale, never a good look 2. The AGM was held today and while they said they expected revenue and profits to increase YoY there was nothing more specific . Point 1 I think had more sway however thinking about the timing of the sale in the days leading up to the AGM , it was either good timing from a price perspective (which is a negative reflection on us as buyers), or he was doing it before getting in front of shareholders at the AGM, potentially a very admirable time. The buying from the lows today was encouraging – we remain holders for now.

Service Stream (SSM) Chart

Broker moves; Gold Road (GOR) the big winner today, jumping into RBC’s top pick list following their quarterly yesterday. The stock jumped +13.66% today as a result.

Elsewhere…

· Independence Group Raised to Hold at Argonaut Securities

· Independence Group Raised to Neutral at JPMorgan; PT A$5.70

· Tourism Holdings Cut to Neutral at Forsyth Barr; PT NZD4

· Inghams Raised to Neutral at UBS; PT A$3.10

· Orica Rated New Hold at Jefferies; PT A$25

· Mesoblast ADRs Assumed Overweight at Cantor; PT $23

· Gold Road Raised to Top Pick at RBC; PT A$1.50

· Gold Road Raised to Hold at Baillieu Ltd

· Orocobre Cut to Neutral at JPMorgan; PT A$2.30

· Saracen Mineral Raised to Hold at Canaccord; PT A$3.75

OUR CALLS

We sold Orica (ORI) and Dominos (DMP) for decent profits today before buying Western Areas (WSA) and Boral (BLD) for the Growth Portfolio today.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.