Markets hit on Coronavirus, stocks exposed to China hardest hit (NWH, EHL, WSA, OSH)

WHAT MATTERED TODAY

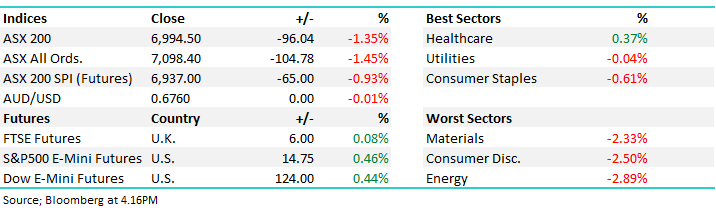

While it was a weak session locally today the low point was seen early on in trade with buyers emerging into weakness, although some sectors were clearly targeted more than others. A lot of news surrounding the Coronavirus with the major implication being a potential reduction in global growth, stocks exposed to China were hit hardest today while the defensive yield / bond proxy trade benefitted from a decline in bond yields. Gold was also a standout as would be expected as demand for safe havens increased.

While the outbreak is a negative for growth, the offset comes from lower from longer interest rates and the potential for China to flex their stimulatory muscle at some point, which is clearly very likely. To date, the pullback is very orderly with the volatility index still at just 18, still low in historical terms. Around the region today, Asian markets were all lower, although mainland China remains on holiday. US Futures tracked higher during our time zone after the Dow declined ~450pts overnight.

Overall, the ASX 200 fell -96pts / -1.35% today to close at 6994, +30pts from the early session low, Dow Futures are trading higher by +124pts/+0.44%

ASX 200 Chart

ASX 200 Chart

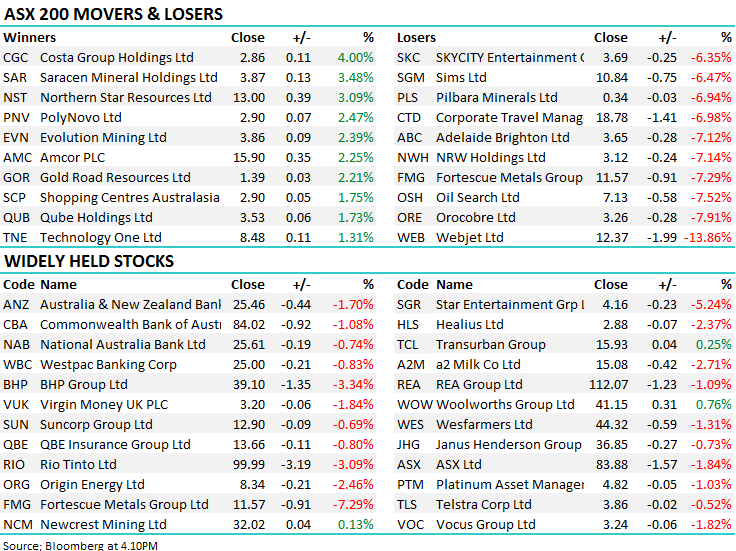

CATCHING MY EYE

China Facing Sectors: Anything with a China focus today saw most selling, the resources hardest hit which is easy to comprehend given China now buys ~70% of the worlds Iron Ore and ~50% of global Copper production, Fortescue Metals (FMG) hit -7.29%, Oz Minerals (OZL) down –5.32% as a consequence however the selling didn’t end there. Travel related stocks also fell hard, Webjet the worst of them down by more than 13%, Qantas (QAN) -5.22%, Treasury Wines (TWE) -5.76% along with the Casino stocks all at the pointy end of the sell-off

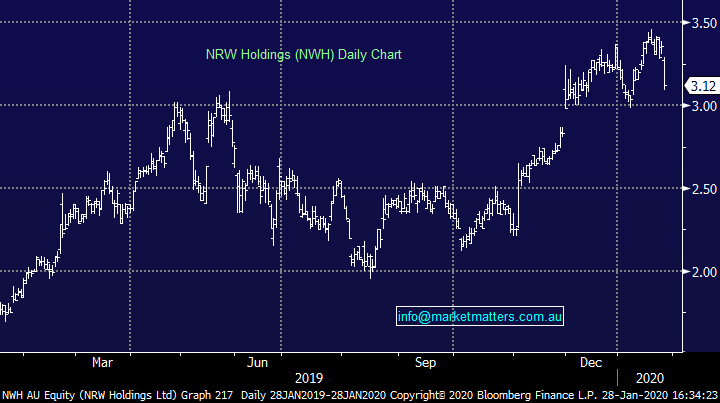

Across our portfolios, the resources were the biggest weight, BHP, RIO, Oz Minerals (OZL) and Western Areas (WSA) all lower, WSA out with production numbers that Harry covers off below while NRW Holdings (NWH) ended down more than 7% after sadly reporting a fatality in one of their new divisions acquired through BGC. On the flip side, our Gold exposure did well while Costa Group (CGC) topped the leaders board adding +4% on the session with a big buyer emerging late in the day.

NRW Holdings (NWH) Chart

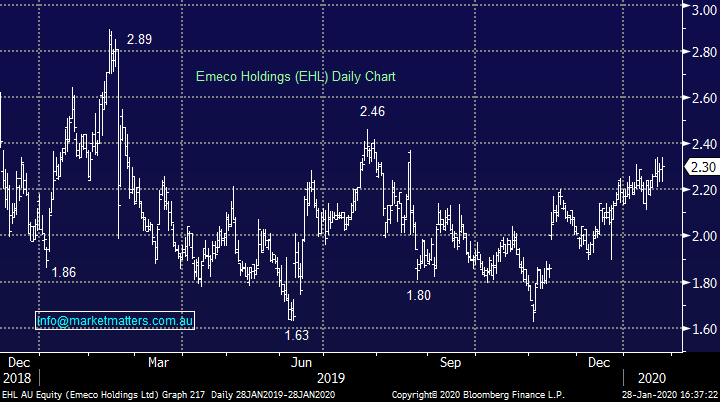

Emeco Holdings (EHL) Trading Halt: Double barrelled news this morning that their credit rating has been upgraded by Moody’s + they are raising capital to pursue an acquisition of Pit N Portal, a specialist in mining and equipment solutions specific to the hard rock sector. Reports being the acquisition will be earnings accretive from the get-go and EHL will fund via an entitlement issue from existing shareholders. EHL has one major shareholder who owns more than 20% of the company, implying they are in full support of the proposed deal (hence the pro-rata entitlement issue). We own EHL and await more detail.

Emeco Holdings (EHL) Chart

Western Areas (WSA) -3.65%; Hit a 4-month low today after announcing their December quarter production numbers to round out the half year. The only real surprise was a fall in sales for the quarter which dipped 20% on the second quarter. The company blamed the bush fires for delays in shipments while mill production remained strong and tracking in line with guidance for the full year.

Costs crept a little higher in the quarter although remained well within guidance of $2.90-$3.30/lb at $3.07/lb for the half. Shares were sold off today, although not all related to the quarterly. Nickel has tracked back to 6 month lows with the coronavirus epidemic impacting commodity prices across the board. We like WSA into the weakness, targeting ~$2.50 to up weight.

Western Areas (WSA) Chart

Oil Search (OSH) –7.52%; the OSH share price took a big hit today, following energy markets lower with increasing coronavirus fears, but also helped lower by a softer fourth quarter report. Production rose around 11% for the 2019 calendar year to 27.95mmboe, coming home with a wet sail to add over 7mmboe in the final quarter and land the year within prior guidance. Growth was driven by record PNG LNG production despite the impact of remediation work that has dragged on since an earthquake in 2018. OSH is in the middle of negotiating a new PNG development with talks remaining behind schedule – timing of projects in PNG have been an issue for most resources companies that take on the terrain – while early drill results out of Alaskan exploration place Oil Search in a good position to continue to drive production higher.

The company also gave early guidance for the new year, with production expected to be flat to marginally higher at 27.5-29.5mmboe in the current year. Oil search will report their full year results in late February.

Oil Search (OSH) Chart

Broker moves;

· Macquarie Group Cut to Hold at Bell Potter; PT A$150

· Macquarie Group Cut to Sell at Citi; PT A$123.50

· Webjet Cut to Underweight at Morgan Stanley; PT A$10

· Bank of Queensland Raised to Neutral at JPMorgan; PT A$7.70

· Rhipe Raised to Buy at Bell Potter; PT A$2.60

· TPG Telecom Raised to Neutral at Credit Suisse; PT A$6.70

· Cooper Energy Rated New Neutral at JPMorgan

· Insurance Australia Cut to Hold at Bell Potter; PT A$7.90

OUR CALLS

No changes across portfolios today.

**CORRECTION**In the Weekend Note we covered off the following in terms of potential portfolio moves, however there was a contradiction in the list around our holding in Bingo (BIN). Bingo should not be in the Adding to list. We covered off on BIN above today and its strength in a market that was falling away is encouraging. We are sitting tight for now.

We have a few positions we are considering adding to, selling and switching etc. in the coming weeks depending how markets evolve – a quick summary of our current thoughts are as follows:

Selling: Bingo (BIN) Newcrest Mining (NCM) and Evolution Mining (EVN).

Reduce: NRW Holdings (NWH) – slightly if at all.

Adding to: Boral (BLD), Bingo (BIN) and Western Areas (WSA).

Buying: Sandfire Resources (SFR) or South32 (S32) and a2 Milk (A2M).

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.